+32

lancelot

sepheronx

sundoesntrise

Broski

flamming_python

AlfaT8

JohninMK

Tsavo Lion

Kimppis

Singular_Transform

miketheterrible

GunshipDemocracy

Regular

OminousSpudd

KoTeMoRe

max steel

Project Canada

par far

kvs

Austin

GarryB

George1

TR1

magnumcromagnon

NationalRus

higurashihougi

Mike E

medo

Viktor

Hannibal Barca

nemrod

Admin

36 posters

Economy of China:

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

- Post n°76

China economy

China economy

China's economy wont collapse. Instead, it will be sustained as it is (kicking the can) till alternative method is in place. Currently, silk road and other investment projects abroad are a way out for China from current method.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

- Post n°77

Re: Economy of China:

Re: Economy of China:

China's debt problem explained. - Thomson Reuters

kvs- Posts : 15738

Points : 15873

Join date : 2014-09-10

Location : Turdope's Kanada

- Post n°78

Re: Economy of China:

Re: Economy of China:

Austin wrote:China's debt problem explained. - Thomson Reuters

Reuters can go and shove itself where the sun don't shine. The way to establish debt carrying capacity is to compare it to assets.

So far China has a much better (i.e. lower) debt to asset ratio than many "solid" (according to Reuters) NATO members.

This western media focus on Chinese debt is a clear destabilization campaign. They know that economics is to a large extent

about human psychology. So if you can spook key players and consumers in general then you can force serious damage.

This is regardless of any actual problem in the target economy. Reuters and the rest of the NATO fake stream media have

been systematically attacking the Russian economy as well. You can see the massive spew of "Russia is going collapse"

excrement since 2014. But the attacks actually predate 2014 and go back to the early 2000s. (I recall the Chicken Little

screeching before 2003 about how the debt service payments in 2003 were going to destroy Russia's budget; but 2003 came

and went and nothing happened).

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°79

Re: Economy of China:

Re: Economy of China:

China's problem is deeper than that.

The Chinese economy is unbalanced on extreme level, and debt is a symptom only.

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&start=1990

The consumption ratio is record low for any economy.

Japan had around 50% when it was hit by the crisis.

The biggest problem of the world is the low consumption level .

The military spending is a good exit route from it : )

The Chinese economy is unbalanced on extreme level, and debt is a symptom only.

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&start=1990

The consumption ratio is record low for any economy.

Japan had around 50% when it was hit by the crisis.

The biggest problem of the world is the low consumption level .

The military spending is a good exit route from it : )

kvs- Posts : 15738

Points : 15873

Join date : 2014-09-10

Location : Turdope's Kanada

- Post n°80

Re: Economy of China:

Re: Economy of China:

Singular_Transform wrote:China's problem is deeper than that.

The Chinese economy is unbalanced on extreme level, and debt is a symptom only.

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&start=1990

The consumption ratio is record low for any economy.

Japan had around 50% when it was hit by the crisis.

The biggest problem of the world is the low consumption level .

The military spending is a good exit route from it : )

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&locations=CN-SG&start=1990

Singapore has the same pattern of consumption. How come I hear nothing about the Singapore economy

being unbalanced. Also, lots of 3rd world countries have high consumption levels relative to GDP, that

does not make them robust economies. So this metric is not quite the smoking gun evidence of China's

problems.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°81

Re: Economy of China:

Re: Economy of China:

kvs wrote:

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&locations=CN-SG&start=1990

Singapore has the same pattern of consumption. How come I hear nothing about the Singapore economy

being unbalanced. Also, lots of 3rd world countries have high consumption levels relative to GDP, that

does not make them robust economies. So this metric is not quite the smoking gun evidence of China's

problems.

Singapore is a small, irrelevant country ,it can run any economy policy without any consequence.

Chine giving 20% of the world GDP on PPP basis.

And the discrepancy even worst than that.

In Russia/Germany/Spain/Hungary the healthcare coming from the government budget, so not counted as consumption ( as far as I'm aware), in Chine it is part of the personal consumption.

In US it blowing up the personal consumption.

Kimppis- Posts : 617

Points : 617

Join date : 2014-12-23

- Post n°82

Re: Economy of China:

Re: Economy of China:

Singular_Transform wrote:kvs wrote:

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?end=2016&locations=CN-SG&start=1990

Singapore has the same pattern of consumption. How come I hear nothing about the Singapore economy

being unbalanced. Also, lots of 3rd world countries have high consumption levels relative to GDP, that

does not make them robust economies. So this metric is not quite the smoking gun evidence of China's

problems.

Singapore is a small, irrelevant country ,it can run any economy policy without any consequence.

Chine giving 20% of the world GDP on PPP basis.

And the discrepancy even worst than that.

In Russia/Germany/Spain/Hungary the healthcare coming from the government budget, so not counted as consumption ( as far as I'm aware), in Chine it is part of the personal consumption.

In US it blowing up the personal consumption.

Total BS, no country can run any economic policy without consequences (maybe except USA, lol), obviously. Not to mention that Japan (even when it was hit by the crisis) and Singapore are fully developed economies.

Currently China's PPP GDP per capita is something like 25% of the US (Russia is at 40-45%, Japan and Singapore 70%+). So people should really stop with these doom-and-gloom stories.

It seems that high savings have been a good thing for East Asian economies, and again: China is really not an exception (if anything it's a positive outlier, even compared to other East Asian economies at the same stage of development), no matter how you try to spin it.

And as kvs said earlier, China's GDP is nowhere near saturation, their foreign debt is miniscule, the economy is heavily under state control (in a good way). Some kind of crisis is of course inevitable, but most likely it won't happen anytime soon. Again, Japan was already fully developed when it stagnated. It's just that China's population is 10 times larger, so it's economy is already many time larger than Japan's. A simple and obvious fact that many seem to forget for some reason - including the Western MSM.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°83

Re: Economy of China:

Re: Economy of China:

Kimppis wrote:

Total BS, no country can run any economic policy without consequences (maybe except USA, lol), obviously. Not to mention that Japan (even when it was hit by the crisis) and Singapore are fully developed economies.

Currently China's PPP GDP per capita is something like 25% of the US (Russia is at 40-45%, Japan and Singapore 70%+). So people should really stop with these doom-and-gloom stories.

It seems that high savings have been a good thing for East Asian economies, and again: China is really not an exception (if anything it's a positive outlier, even compared to other East Asian economies at the same stage of development), no matter how you try to spin it.

And as kvs said earlier, China's GDP is nowhere near saturation, their foreign debt is miniscule, the economy is heavily under state control (in a good way). Some kind of crisis is of course inevitable, but most likely it won't happen anytime soon. Again, Japan was already fully developed when it stagnated. It's just that China's population is 10 times larger, so it's economy is already many time larger than Japan's. A simple and obvious fact that many seem to forget for some reason - including the Western MSM.

The US trade policy is dictated by its foreign policy.

And it is quite disastrous for the US economy.

The key is the TRADE.

If a country small then it can run any trade balance as it wish.

If big then it works only for limited time.

Anyway, China manufacturing more heavy duty truck than the US+ EU + Japan COMBINED.

Same true for steel / cement and so on.

Means big part of the economy is on the same level like the US or EU, and it is nothing else than ( surprise) investment + trade related industries.

The CONSUMPTION is seriously underdeveloped.

So, arguing against that the Chinese economy is unbalanced is like saying that the pigs can fly.

Previous examples for similar issues:

Great depression of US

Soviet crisis in 70-80

Japanese lost decade

Argentine crisis

Mexican crisis

and so on.

Kimppis- Posts : 617

Points : 617

Join date : 2014-12-23

- Post n°84

Re: Economy of China:

Re: Economy of China:

Sure there is overproduction. And the problem is being dealth with atm.

When it comes to consumption... it's actually booming. The service sector is already over 50% of GDP and over 70% of economic growth. China is already the largest market for many products. If a country is already the largest market for the likes of Apple, while having a modest GDP per capita, it can't have some massive problems with consumption, quite the opposite.

Not to mention that according to recent reports, domestic demand's share of GDP growth is something like 95%, currently. Which makes perfect sense, considering that global trade has been stagnating and the Chinese economy is still growing by almost 7% a year. The stereotype that the Chinese economy is somehow massively dependent on exports is very outdated and it was always exaggerated.

So if anything, Chinese GDP is underestimated... by something like 20% and in reality it's more developed than the official figures would indicate. So IMO it's likely we will see upwards adjustments in the near future. Which means that the consumption as a % of GDP is also higher. And in any case, you're probably using outdated numbers.

When it comes to consumption... it's actually booming. The service sector is already over 50% of GDP and over 70% of economic growth. China is already the largest market for many products. If a country is already the largest market for the likes of Apple, while having a modest GDP per capita, it can't have some massive problems with consumption, quite the opposite.

Not to mention that according to recent reports, domestic demand's share of GDP growth is something like 95%, currently. Which makes perfect sense, considering that global trade has been stagnating and the Chinese economy is still growing by almost 7% a year. The stereotype that the Chinese economy is somehow massively dependent on exports is very outdated and it was always exaggerated.

So if anything, Chinese GDP is underestimated... by something like 20% and in reality it's more developed than the official figures would indicate. So IMO it's likely we will see upwards adjustments in the near future. Which means that the consumption as a % of GDP is also higher. And in any case, you're probably using outdated numbers.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°85

Re: Economy of China:

Re: Economy of China:

Kimppis wrote:Sure there is overproduction. And the problem is being dealth with atm.

When it comes to consumption... it's actually booming. The service sector is already over 50% of GDP and over 70% of economic growth. China is already the largest market for many products. If a country is already the largest market for the likes of Apple, while having a modest GDP per capita, it can't have some massive problems with consumption, quite the opposite.

Not to mention that according to recent reports, domestic demand's share of GDP growth is something like 95%, currently. Which makes perfect sense, considering that global trade has been stagnating and the Chinese economy is still growing by almost 7% a year. The stereotype that the Chinese economy is somehow massively dependent on exports is very outdated and it was always exaggerated.

So if anything, Chinese GDP is underestimated... by something like 20% and in reality it's more developed than the official figures would indicate. So IMO it's likely we will see upwards adjustments in the near future. Which means that the consumption as a % of GDP is also higher. And in any case, you're probably using outdated numbers.

so , let analyse your statement.

We know that the chinese economy was driven from 1980 by the high investment (and export, but that is the smaller contributor).

Based on this we can make a quite well established assumption about that the Chinese economical policy / politics/ legal system geared to deliver this growth.

We know that as well centrally controlled economies ( like the CCCP between 1950-1975) are quite good to drive investment based growth.

But based on the above data ho can you claim that China can show a miraculous ( and absolutely unique and one off from historical perspective) transformation from investment driven economy to consumption driven one?

The investment driven growth benefited the wealthy and the politically well connected, the consumption driven benefiting the average Chinese.

See the problem?

It is easy to change the growth model IF you can force the wealthy to give up its money, and the powerful to give up its power.

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

- Post n°86

Re: Economy of China:

Re: Economy of China:

Not necessarily. The rich will end up keeping their wealth by making their products more inclined to domestic consumption. They have a population of about 1.3B people. Sell an item for $1 to 300M, you made $300M in sales. If the average person makes more, the more they can spend.

Its the import/export oligarchs who will get hurt.

Its the import/export oligarchs who will get hurt.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°87

Re: Economy of China:

Re: Economy of China:

miketheterrible wrote:Not necessarily. The rich will end up keeping their wealth by making their products more inclined to domestic consumption. They have a population of about 1.3B people. Sell an item for $1 to 300M, you made $300M in sales. If the average person makes more, the more they can spend.

Its the import/export oligarchs who will get hurt.

The persons who have money in chine collected it NOT because they know that what the consumers wants OR how to organise business OR how to make things for cheap but because they know the right person or they are in the right position.

So these guys have to lose the money, and the guys who capable to organise business and run it profitable has to receive it : )

And the backbone of the process is the more and more expensive workforce , that forcing the businesses to cut cost or die.

This is the problem of the Russian or American economy.

Too many powerful interest trashing the politician and economical processes.

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

- Post n°88

Re: Economy of China:

Re: Economy of China:

Don't know about that. Russia is a huge consumer and the import substitution was somewhat a success and is still in full driving force.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

- Post n°89

Re: Economy of China:

Re: Economy of China:

miketheterrible wrote:Don't know about that. Russia is a huge consumer and the import substitution was somewhat a success and is still in full driving force.

In the past few years they cut back the consumption in Russia, I presume to move money into investment.

Should be interesting to see the end.

But the stable level of employment promising.

Kimppis- Posts : 617

Points : 617

Join date : 2014-12-23

- Post n°90

Re: Economy of China:

Re: Economy of China:

Well, when it comes to China's economic growth, South Korea seems to be a very similar case. South Korea used to be poorer than the North. South Korea began its fast economic growth roughly 2 decades earlier than China... so right now China simply tracks 2 decades behind South Korea.

http://www.unz.com/akarlin/twenty-year-rule/

And again, the Chinese growth is increasingly based on consumption as I pointed out on my previous post.

http://www.unz.com/akarlin/twenty-year-rule/

And again, the Chinese growth is increasingly based on consumption as I pointed out on my previous post.

Singular_Transform- Posts : 1032

Points : 1014

Join date : 2016-11-13

Kimppis wrote:Well, when it comes to China's economic growth, South Korea seems to be a very similar case. South Korea used to be poorer than the North. South Korea began its fast economic growth roughly 2 decades earlier than China... so right now China simply tracks 2 decades behind South Korea.

http://www.unz.com/akarlin/twenty-year-rule/

And again, the Chinese growth is increasingly based on consumption as I pointed out on my previous post.

Nice finding : )

Both of them small compared to China.

Japan and Korea can use the export way more than china, simply due to the different size.

The only way for China is the same that the US had to walk.

But that is painful. Starting with new legal and political system....

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

China Is Taking On the ‘Original Sin’ of Its Mountain of Debt

Reducing leverage risks touted as top priority for regulators

Wealth management products, entrusted loan levels remain high

Reducing leverage risks touted as top priority for regulators

Wealth management products, entrusted loan levels remain high

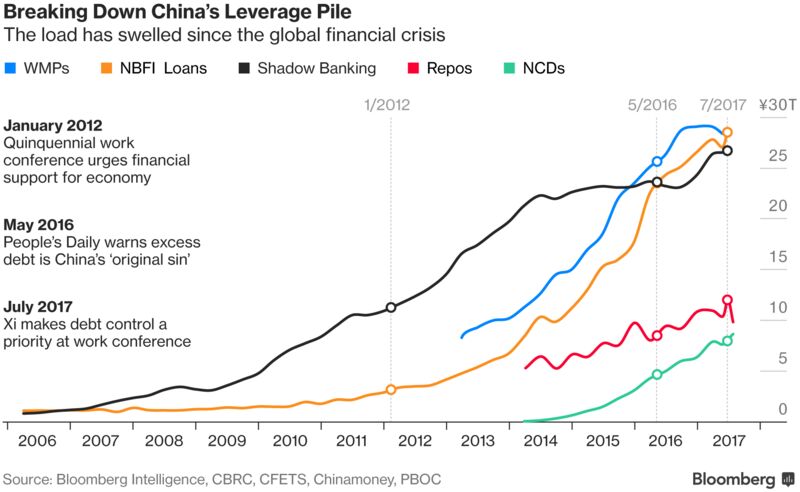

China’s much-vaunted campaign to tackle its leverage problem has captured headlines this year. But to understand why they’re taking on the challenge -- and the threat it could pose to the world’s second-largest economy -- you need to dig into the mountain.

Characterized in state media as the “original sin” of China’s financial system, leverage has swelled over the past decade -- partly because policy makers were trying to cushion a slowdown in growth from the old normal of 10 percent plus. What’s fueled the leverage has been a rapid expansion in household and corporate wealth looking for higher returns in a system where bank interest rates have been held down.

The unprecedented stimulus unleashed since 2008 effectively brought to life the “monster” China’s leadership is now trying to tackle, says Andrew Collier, managing director of Orient Capital Research Ltd. in Hong Kong and author of “Shadow Banking and the Rise of Capitalism in China.”

Implicit backing from the central government meant borrowers had free license to take on debt.

“You basically have anybody selling anything they want as they think they can’t lose,” Collier said. Deleveraging -- championed by President Xi Jinping and the Communist Party Politburo in April -- hasn’t truly begun, as “they’re trying to forestall the pain as long as possible,” he said.

Read more here about how the focus of deleveraging has been shifting.

The equivalent of trillions of dollars are now held in all manner of assets in China, from high-yielding wealth management products to so-called entrusted investments.

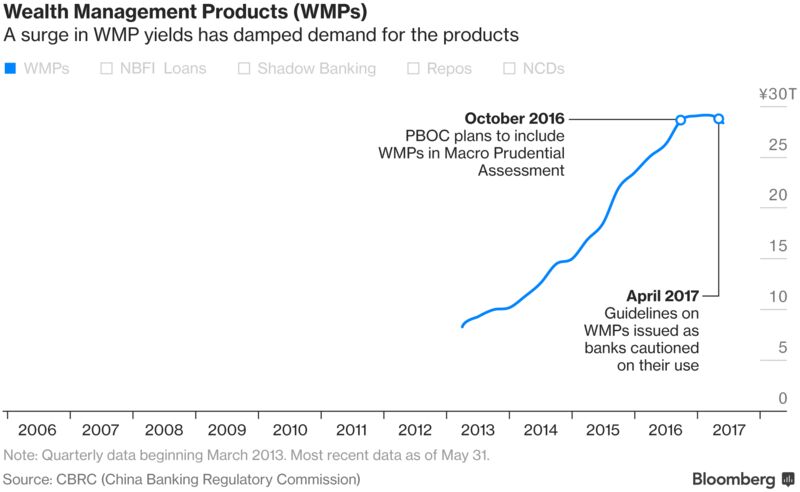

Taking the heftiest piece of the leverage mountain first, wealth management products had a precipitous rise over the past several years.

A way for borrowers who have trouble getting traditional bank loans to win funding, WMPs have grown in popularity as they typically offer savers much higher yields than banks offer on deposits.

WMPs are also a hit because they give lenders a way to keep loans off of their balance sheets, and to skirt regulatory requirements when channeling funds to borrowers, according to Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. in Hong Kong.

The regulatory crackdown this year -- mostly in the form of more stringent guidelines on use of financial products -- has seen the amount of WMPs outstanding taper off from a peak in April, while yields on them have surged as providers competed for funds. In July, the bank watchdog is said to have told some lenders to cut the rates they offered on the products.

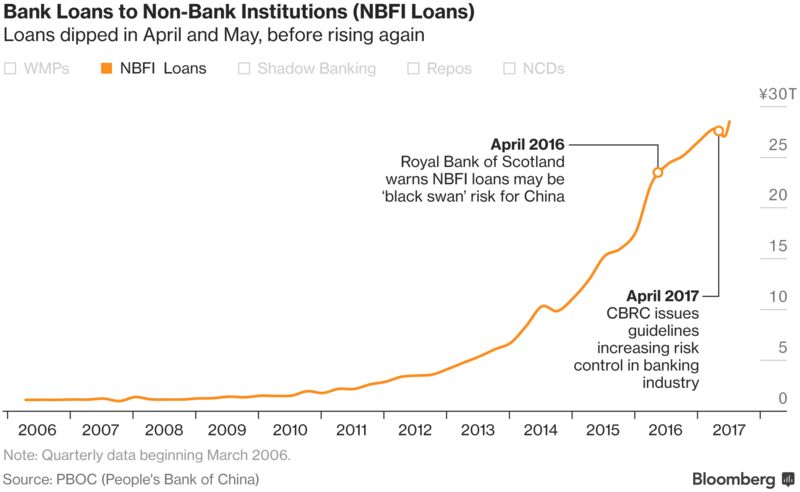

Turning to loans by banks to non-financial institutions, this is an area that’s yet to be dented much by what Xi has characterized as a de-risking drive. Yeung says the leadership’s campaign poses a “real test” for China and its regulators.

“On the one hand, they don’t want this overall deleveraging to have any negative impact on real economic activities,” he said. “At the same time, they know if they don’t do it right now that it will become another financial bubble pretty soon.”

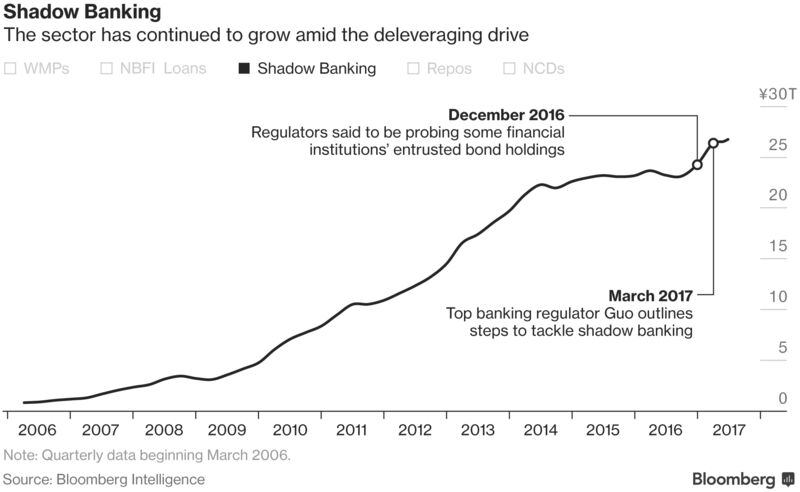

Since regulators ramped up their measures to curb financial leverage at the start of April, shadow banking has been in the cross-hairs.

The most popular forms include entrusted loan agreements (when a company lends money to another company with the bank as the middleman), trust loans (where banks use money raised from WMPs to invest in trust plans, with the proceeds eventually going to a corporate borrower) and bankers’ acceptances (a bank-backed guarantee for a future payment).

Data compiled by Bloomberg Intelligence tracking all three sectors show shadow banking still amounted to a record 26.7 trillion yuan as of the end of June.

Shadow financing is seen as one of the culprits behind China’s property-price surge, and regulators this year banned private-equity lending to developers for land purchases. Banks also were told in March to submit reports on their entrusted investments -- funds that Chinese lenders farm out to external asset managers -- and Beijing recently extended the deadline after some struggled to determine the scope of their exposures.

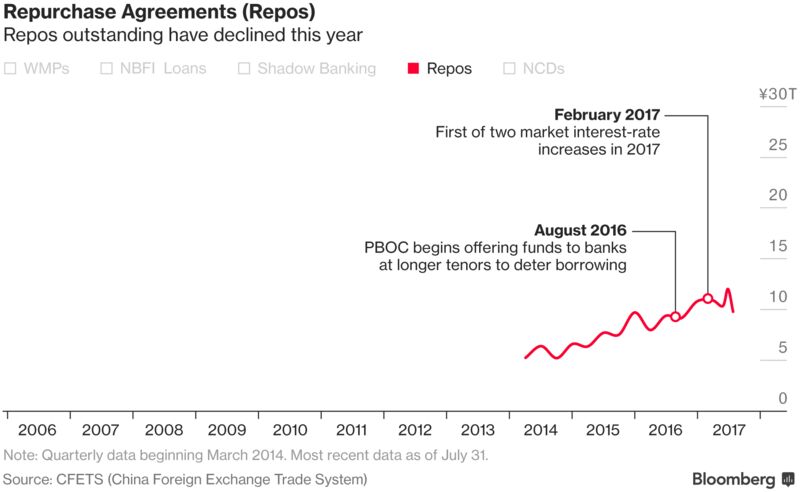

More directly connected to markets are repurchase agreements, where participants can get cash for set periods. A key tool for officials to rein in borrowing has been boosting funding costs in the money market. And indeed, the amount of repos outstanding has come off since reaching a peak at the end of June.

The People’s Bank of China in March hiked rates on reverse-repurchase agreements and also raised the cost of medium-term loans. HSBC Holdings Plc analysts are among those seeing some further boost to money-market rates.

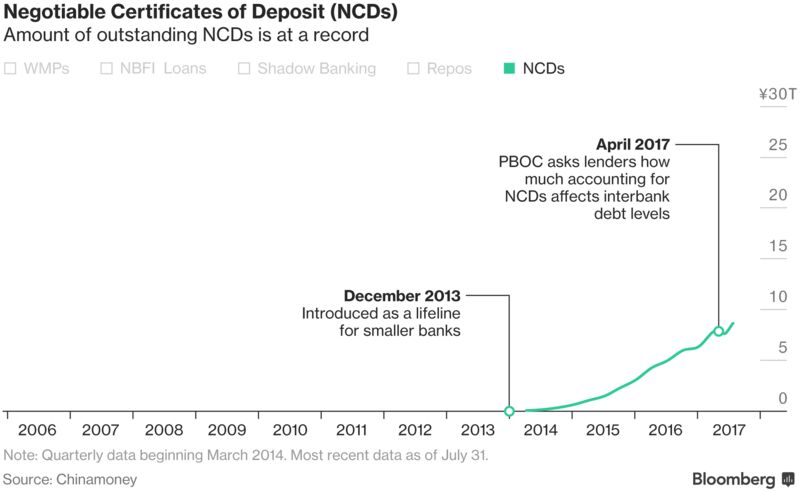

Negotiable certificates of deposit are relative minnows in China’s ocean of leverage, but they are a lifeline for smaller banks that have difficulty competing for savings against the big state lenders.

NCDs morphed into a way for small banks to fund purchases of each other’s WMPs, with a circular arrangement developing whereby the banks selling the products would then channel the proceeds into the bond market, resulting in a mismatch between the shorter-term NCDs and other debt investments.

After dipping slightly in May as the deleveraging rhetoric intensified, the amount of NCDs outstanding has started rising again, reaching a record last month.

Earlier in the year, the PBOC was said to be mulling requiring lenders to re-classify NCDs as interbank liabilities, a move that would likely quell their growth because of limits on how much interbank debt banks are allowed to hold relative to their overall liabilities.

China’s monetary authorities for years focused on incubating innovation in the financial system, after decades when Soviet-style command and control was the model. Having successfully overseen an explosion in new types of credit, they are having to pivot into the role of gatekeepers and supervisors -- and to coordinate themselves better as risks pile up, according to Yeung and his colleagues at ANZ.

“This will certainly challenge the technical abilities as well as the mindset of regulators.”

— With assistance by Emma O'Brien, Eric Lam, Adrian Leung, Jun Luo, Jing Zhao, Helen Sun, and Xize Kang

George1- Posts : 18486

Points : 18987

Join date : 2011-12-22

Location : Greece

China took long-term lease of the deep-water port of Hambantota in Sri Lanka

https://bmpd.livejournal.com/3012022.html

https://bmpd.livejournal.com/3012022.html

Tsavo Lion- Posts : 5961

Points : 5913

Join date : 2016-08-15

Location : AZ, USA

- Post n°94

Re: Economy of China:

Re: Economy of China:

"One belt - one way” implies a “big game” and a “big battle” https://regnum.ru/news/polit/2726894.html

Tsavo Lion- Posts : 5961

Points : 5913

Join date : 2016-08-15

Location : AZ, USA

https://www.janes.com/article/92086/china-singapore-enhance-bilateral-defence-co-operation

China and Indonesia speed up regional infrastructure construction: https://regnum.ru/news/polit/2760166.html

This is bad news for India, Japan & the US!

China and Indonesia speed up regional infrastructure construction: https://regnum.ru/news/polit/2760166.html

This is bad news for India, Japan & the US!

Last edited by Tsavo Lion on Sat Oct 26, 2019 7:36 pm; edited 1 time in total (Reason for editing : add link)

JohninMK- Posts : 15553

Points : 15694

Join date : 2015-06-16

Location : England

- Post n°96

Strengthening the economy is the plan.

Strengthening the economy is the plan.

Strengthening the economy is the plan.

Spriter

@spriter99880

·

21m

A very important step towards signing a memorandum of strategic cooperation with China ..

Syria and China, today Wednesday, signed a note of understanding in the framework of the "Economic Belt Initiative for the Silk Road and the Marine Silk Road in the 21st Century."

Spriter

@spriter99880

·

21m

A very important step towards signing a memorandum of strategic cooperation with China ..

Syria and China, today Wednesday, signed a note of understanding in the framework of the "Economic Belt Initiative for the Silk Road and the Marine Silk Road in the 21st Century."

Hole and lancelot like this post

AlfaT8- Posts : 2487

Points : 2478

Join date : 2013-02-01

- Post n°97

Re: Economy of China:

Re: Economy of China:

To hell with it, lets revive this thread.

All this talk about the collapse of China's economy needs to be posted somewhere.

All this talk about the collapse of China's economy needs to be posted somewhere.

flamming_python- Posts : 9517

Points : 9577

Join date : 2012-01-30

- Post n°98

Re: Economy of China:

Re: Economy of China:

AlfaT8 wrote:To hell with it, lets revive this thread.

All this talk about the collapse of China's economy needs to be posted somewhere.

Is that like the talk of Russia losing in the Ukraine?

GarryB, GunshipDemocracy and Broski like this post

AlfaT8- Posts : 2487

Points : 2478

Join date : 2013-02-01

- Post n°99

Re: Economy of China:

Re: Economy of China:

flamming_python wrote:AlfaT8 wrote:To hell with it, lets revive this thread.

All this talk about the collapse of China's economy needs to be posted somewhere.

Is that like the talk of Russia losing in the Ukraine?

Nah, these guys are trying to use some hard numbers.

They try to be better than the Caspian report idiots.

flamming_python and GunshipDemocracy like this post

Broski- Posts : 770

Points : 768

Join date : 2021-07-12

- Post n°100

Re: Economy of China:

Re: Economy of China:

Interesting thing about the Chinese, almost all of their debt is internal which means at worst, they can "forgive the debt" of their state owned companies and devalue their currency which wouldn't hurt their export-oriented economy.AlfaT8 wrote:flamming_python wrote:

Is that like the talk of Russia losing in the Ukraine?

Nah, these guys are trying to use some hard numbers.

They try to be better than the Caspian report idiots.

Indebted foreign-owned companies operating there would get swallowed up, and life would go on as normal. US debt is mostly owned by private and foreign interests that have no intention of forgiving their debt and any kind of significant currency devaluation of the USD means they can kiss their World Reserve Currency status goodbye.

GarryB, flamming_python, AlfaT8 and GunshipDemocracy like this post

|

|

|