+32

lancelot

sepheronx

sundoesntrise

Broski

flamming_python

AlfaT8

JohninMK

Tsavo Lion

Kimppis

Singular_Transform

miketheterrible

GunshipDemocracy

Regular

OminousSpudd

KoTeMoRe

max steel

Project Canada

par far

kvs

Austin

GarryB

George1

TR1

magnumcromagnon

NationalRus

higurashihougi

Mike E

medo

Viktor

Hannibal Barca

nemrod

Admin

36 posters

Economy of China:

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°51

Re: Economy of China:

Re: Economy of China:

China Will Get Rich Before It Grows Old

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°52

Re: Economy of China:

Re: Economy of China:

IMF Greenlights Addition Of Chinese Yuan To SDR Basket

While none of the currencies globally are viable under the current debt based monetary system but there is no viable solution yet on how to make people around the world use something/anything as a medium of exchange that is divisible and 'trusted' and is 'legal tender'.

Having said that, finding a new system and the costs associated with it will also be very challenging in current difficult times.

We have come thus far post the GFC mainly due to money printing, QE and whatever wars had to be fought.

We must remember that EUR was just born in 1997 and implemented in electronic form in 1998 and from Jan 1999 it became legal tender in currency notes form.

It is my view that China will keep rising, and IMF's SDR inclusion is just paving the way forward and strengthening the currency. As US loses it's grip on the global monetary system, it is hard for the American Govt hegemons to accept it thus China had to wait until now. If it was me, Chinese yuan would have been in IMF SDR about a decade ago when the manufacturing prowess of China was at it's peak.

We shall have many crises in the years ahead but inclusion of Chinese Yuan in the IMF led SDR basket which is the monetary system AS ON DATE will not make it any worse but slightly better because this will bring stability.

Global trade and spneding is increasingly being done in yuan and most goods are made in China whether we like it or not, and hence all the 210 countries need to have yuan available in their banking systems in order to continue trading with China.

In fact, this will make things slightly cheaper because globally, the wholesalers will not need to price in the FX fluctuations which they currently do when remitting to China.

Screw the big G-7 banks, they always have an agenda of their own survival. Usually they always lie and most analycysts are a pain in the butt anyways.

I am waiting for the day within the next few months when Saudi (post OPEC break up?) will announce acceptance of yuan for oil which will be the last day of the connection between the world's USD based monetary system as we know it and the new monetary system where Yuan will rule the roost over the next few decades.

Every single day, oil remains below USD 50-60 level, the neeed for the world's top 10 oil producers rises more and more and they are choking by this USD based system especially when US is no longer the world's top oil importer.......Why are the Chinese forced to pay in USD when they can simply use CNH....hence Chinese have stopped buying from Saudi and Saudi exports of oil to China have dropped 35% over the last decade.....

Same for India or any other major oil importer, if they buy oil in USD, it makes things that much more expensive due to exchange rates. The day the exporters move away from USD, they have to go closer to CNH being their largest importer of oil which is why inclusion of CNH in IMF's SDR is very important step for China who have got this approval to occur on Nov 30 this year instead of the date announced by IMF a few weeks ago of Oct 2016 for which in all likelihood, US was involved in pushing the day further.

We should hear the news on Dec 1 when the CNH will be included in IMF's SDR and this will be a major game changer because all Govt's will need to hold trillions in CNH in order to assist their domestic banks/importers to pay China in yuan.

While none of the currencies globally are viable under the current debt based monetary system but there is no viable solution yet on how to make people around the world use something/anything as a medium of exchange that is divisible and 'trusted' and is 'legal tender'.

Having said that, finding a new system and the costs associated with it will also be very challenging in current difficult times.

We have come thus far post the GFC mainly due to money printing, QE and whatever wars had to be fought.

We must remember that EUR was just born in 1997 and implemented in electronic form in 1998 and from Jan 1999 it became legal tender in currency notes form.

It is my view that China will keep rising, and IMF's SDR inclusion is just paving the way forward and strengthening the currency. As US loses it's grip on the global monetary system, it is hard for the American Govt hegemons to accept it thus China had to wait until now. If it was me, Chinese yuan would have been in IMF SDR about a decade ago when the manufacturing prowess of China was at it's peak.

We shall have many crises in the years ahead but inclusion of Chinese Yuan in the IMF led SDR basket which is the monetary system AS ON DATE will not make it any worse but slightly better because this will bring stability.

Global trade and spneding is increasingly being done in yuan and most goods are made in China whether we like it or not, and hence all the 210 countries need to have yuan available in their banking systems in order to continue trading with China.

In fact, this will make things slightly cheaper because globally, the wholesalers will not need to price in the FX fluctuations which they currently do when remitting to China.

Screw the big G-7 banks, they always have an agenda of their own survival. Usually they always lie and most analycysts are a pain in the butt anyways.

I am waiting for the day within the next few months when Saudi (post OPEC break up?) will announce acceptance of yuan for oil which will be the last day of the connection between the world's USD based monetary system as we know it and the new monetary system where Yuan will rule the roost over the next few decades.

Every single day, oil remains below USD 50-60 level, the neeed for the world's top 10 oil producers rises more and more and they are choking by this USD based system especially when US is no longer the world's top oil importer.......Why are the Chinese forced to pay in USD when they can simply use CNH....hence Chinese have stopped buying from Saudi and Saudi exports of oil to China have dropped 35% over the last decade.....

Same for India or any other major oil importer, if they buy oil in USD, it makes things that much more expensive due to exchange rates. The day the exporters move away from USD, they have to go closer to CNH being their largest importer of oil which is why inclusion of CNH in IMF's SDR is very important step for China who have got this approval to occur on Nov 30 this year instead of the date announced by IMF a few weeks ago of Oct 2016 for which in all likelihood, US was involved in pushing the day further.

We should hear the news on Dec 1 when the CNH will be included in IMF's SDR and this will be a major game changer because all Govt's will need to hold trillions in CNH in order to assist their domestic banks/importers to pay China in yuan.

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°53

Re: Economy of China:

Re: Economy of China:

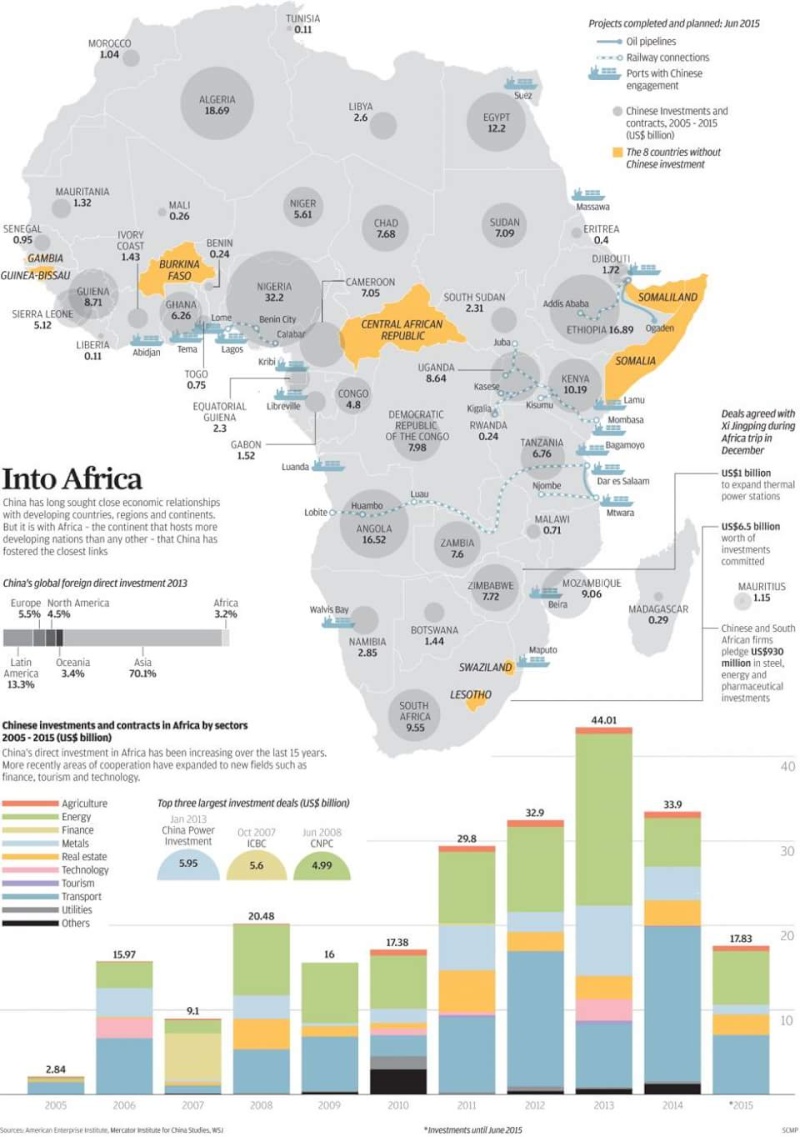

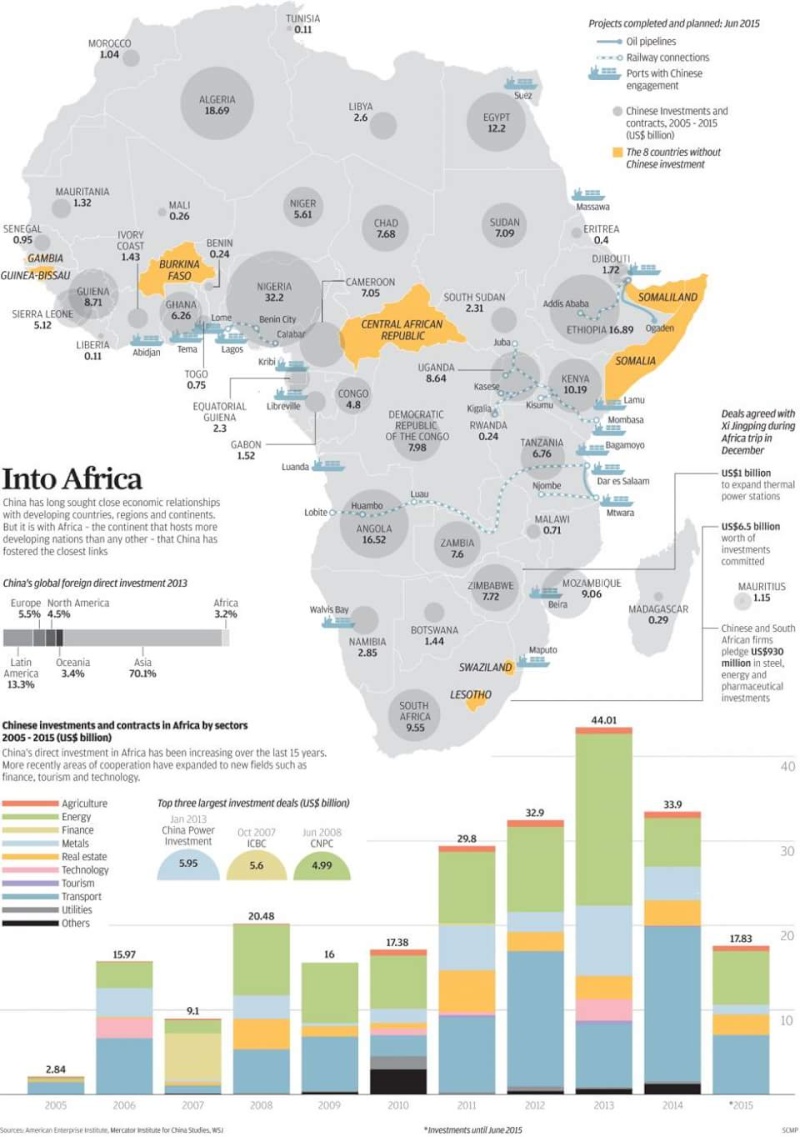

China's contribution in Africa :

Meanwhile Zimbabwe adopts Chinese Yuan

Zimbabwe already had multiple currencies but now it is kind of formalising the yuan and is relieving the USD from such a heavy responsibility! (rather kicking the USD out as 2015 slides into history).

(rather kicking the USD out as 2015 slides into history).

USD is losing a battle worldwide from Angola to Russia to Iran to Zimbabwe to Venezuela and many more nations who are choosing the yuan and dropping the USD for trade, reserves, investments etc!

The main decision has to be made by Saudi/OPEC and that day should come any time (sooner they do it, better it will be for them, because at least they will get to keep their reserves else in 2 years the reserves will be gone and the currency will need to be depegged from the USD anyways) who have to choose yuan instead of USD for sale of oil.

Meanwhile Zimbabwe adopts Chinese Yuan

Zimbabwe already had multiple currencies but now it is kind of formalising the yuan and is relieving the USD from such a heavy responsibility!

USD is losing a battle worldwide from Angola to Russia to Iran to Zimbabwe to Venezuela and many more nations who are choosing the yuan and dropping the USD for trade, reserves, investments etc!

The main decision has to be made by Saudi/OPEC and that day should come any time (sooner they do it, better it will be for them, because at least they will get to keep their reserves else in 2 years the reserves will be gone and the currency will need to be depegged from the USD anyways) who have to choose yuan instead of USD for sale of oil.

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°54

Re: Economy of China:

Re: Economy of China:

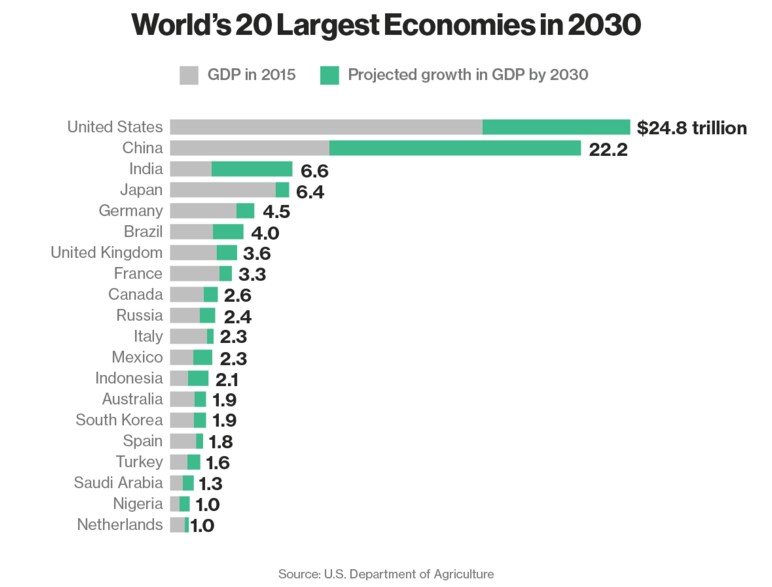

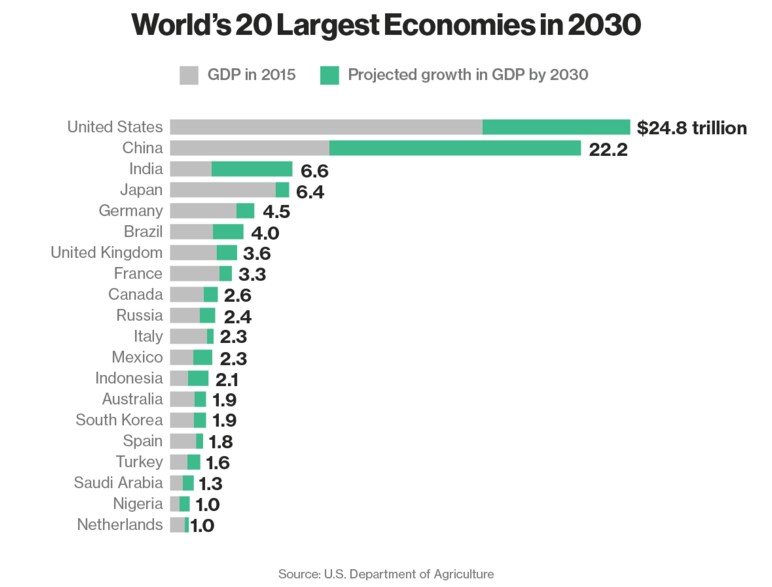

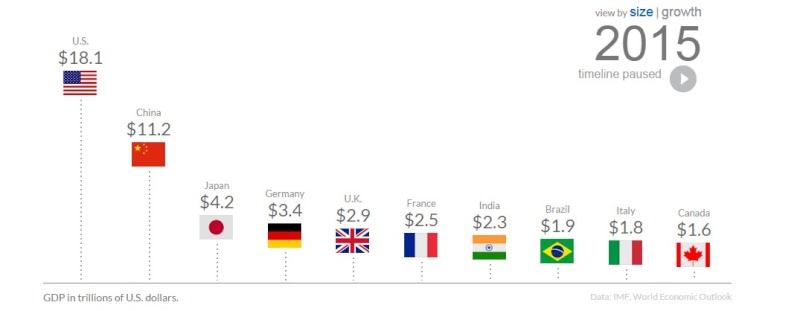

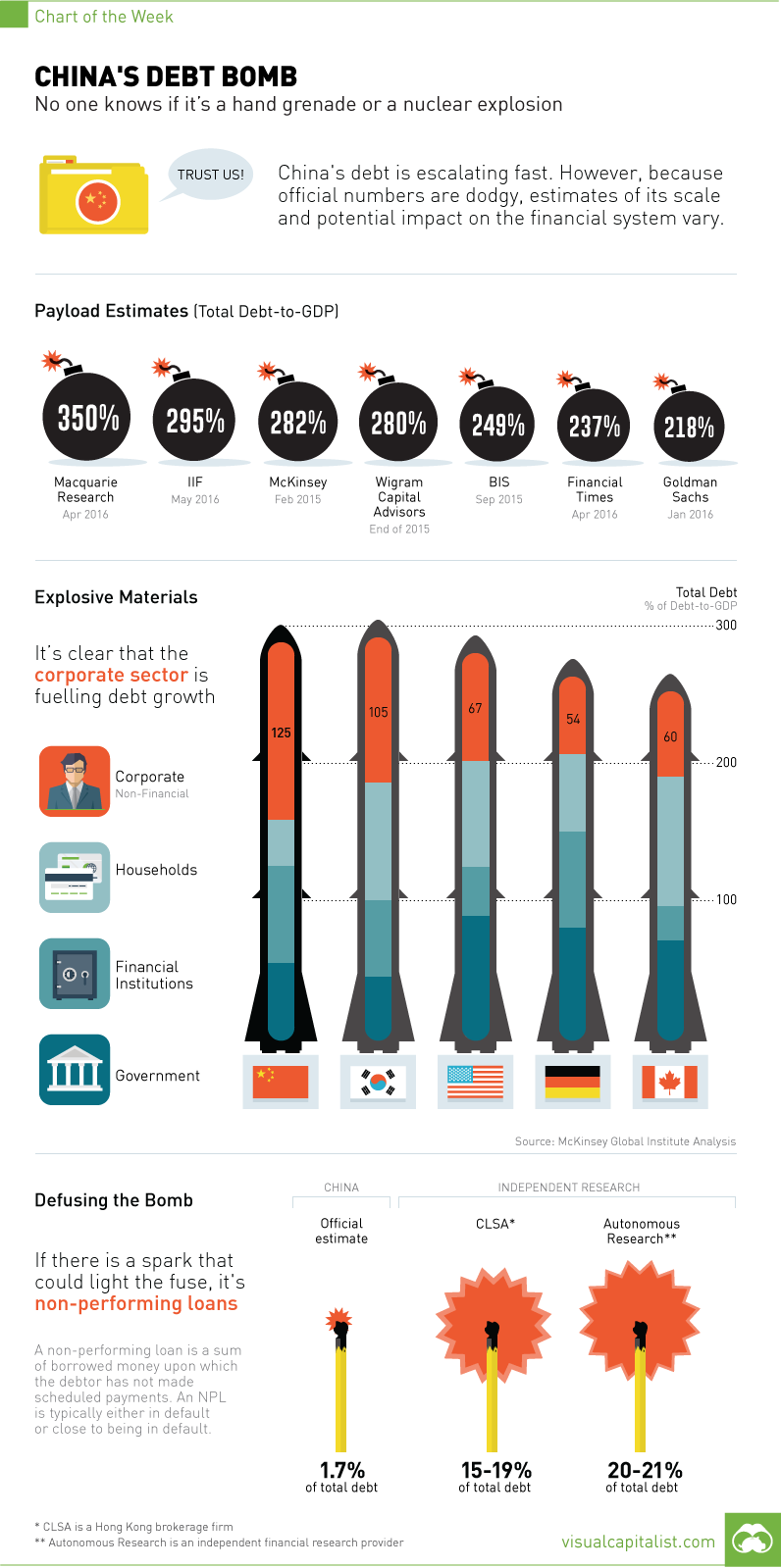

World's 20 Largest Economies in 2030

Get ready for a new economic order. In the world 15 years from now, the U.S. will be far less dominant, several emerging markets will catapult into prominence, and some of the largest European economies will be slipping behind.

That's according to the U.S. Department of Agriculture's latest macroeconomic projections that go out to 2030, displayed in the chart below. The U.S. will just barely remain the global leader, with $24.8 trillion in annual output. The gray bar represents the $16.8 trillion gross domestic product projected for 2015, and the green bar shows how much bigger the economy is expected to be 15 years from now. The country, worth 25 percent of the world economy in 2006 and 23 percent in 2015, will see its share decline to 20 percent.

China's GDP will grow to more than twice its size today, helping the Asian powerhouse to almost entirely close its gap with the U.S. India, ranked eighth for 2015, will climb past Brazil, the United Kingdom, France, Germany and Japan to take third place in the world ranking. The International Monetary Fund calls India "the bright spot in the global landscape." The country will have the largest workforce in the world within the next 15 years, the IMF notes, and among the youngest.

Other nations won't be so lucky, particularly among developed economies. Japan, which was a roaring economy until its asset bubble burst in the early 1990s, has already slogged through decades of stagnation and will likely continue to see very little growth over the next 15 years. That will push Japan down a spot in the rankings by 2030, according to the USDA estimates.

Japan is "an important lesson in how quickly you can downshift your status of what a structure of an economy delivers," said Bruce Kasman,JPMorgn's chief economist. France will slide three spots, while Italy drops two.

In the overall ranking, Jamaica will surrender the most ground, bumping down 13 places to 136. Countries with the biggest advances -- like Uganda, which will climb 18 spots to rank 91 -- are concentrated in Africa, Asia and the Middle East. It's important to take estimates stretching out so far with a note of caution, though.

"There are lots of uncertainties," said Kasman. "Whether China grows at 4 percent or 6 percent matters an awful lot for where it looks like it's going to be in the global economy. Whether India grows at 3 percent or 8 percent -- these are huge differences when you compound them over long periods of time." The USDA is not the only -- and hardly the most widely-followed -- ranking of global economic growth, though it does offer the advantage of particularly long-term outlooks. The International Monetary Fund's economic outlook only projects out two years.

Look out for it later this month.And if 15 years is too far out for you, take a look at the fastest-growing economies just for this year.

Get ready for a new economic order. In the world 15 years from now, the U.S. will be far less dominant, several emerging markets will catapult into prominence, and some of the largest European economies will be slipping behind.

That's according to the U.S. Department of Agriculture's latest macroeconomic projections that go out to 2030, displayed in the chart below. The U.S. will just barely remain the global leader, with $24.8 trillion in annual output. The gray bar represents the $16.8 trillion gross domestic product projected for 2015, and the green bar shows how much bigger the economy is expected to be 15 years from now. The country, worth 25 percent of the world economy in 2006 and 23 percent in 2015, will see its share decline to 20 percent.

China's GDP will grow to more than twice its size today, helping the Asian powerhouse to almost entirely close its gap with the U.S. India, ranked eighth for 2015, will climb past Brazil, the United Kingdom, France, Germany and Japan to take third place in the world ranking. The International Monetary Fund calls India "the bright spot in the global landscape." The country will have the largest workforce in the world within the next 15 years, the IMF notes, and among the youngest.

Other nations won't be so lucky, particularly among developed economies. Japan, which was a roaring economy until its asset bubble burst in the early 1990s, has already slogged through decades of stagnation and will likely continue to see very little growth over the next 15 years. That will push Japan down a spot in the rankings by 2030, according to the USDA estimates.

Japan is "an important lesson in how quickly you can downshift your status of what a structure of an economy delivers," said Bruce Kasman,JPMorgn's chief economist. France will slide three spots, while Italy drops two.

In the overall ranking, Jamaica will surrender the most ground, bumping down 13 places to 136. Countries with the biggest advances -- like Uganda, which will climb 18 spots to rank 91 -- are concentrated in Africa, Asia and the Middle East. It's important to take estimates stretching out so far with a note of caution, though.

"There are lots of uncertainties," said Kasman. "Whether China grows at 4 percent or 6 percent matters an awful lot for where it looks like it's going to be in the global economy. Whether India grows at 3 percent or 8 percent -- these are huge differences when you compound them over long periods of time." The USDA is not the only -- and hardly the most widely-followed -- ranking of global economic growth, though it does offer the advantage of particularly long-term outlooks. The International Monetary Fund's economic outlook only projects out two years.

Look out for it later this month.And if 15 years is too far out for you, take a look at the fastest-growing economies just for this year.

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°55

Re: Economy of China:

Re: Economy of China:

The doomsayers have it wrong about China

Celebrate the rise of flawed, febrile China.For all the risks, we should celebrate its rise to the world’s second-largest economy.It is easy to imagine China’s economic freight train going off the rails. When I came to Asia 14 years ago, many people in Japan, where the economy was then three times the size of China’s in nominal terms, were predicting precisely that. Surely, they reasoned, the system must crumble under its own contradictions.

It was, after all, a state-managed economy prone to misallocation of capital and dependent on wasteful investment. It had a repressive political apparatus that spent more on internal security than on national defence.

Anger was growing at Communist party officials, many of whom were neck deep in corruption and engaged in land grabbing on an epic scale. Crudely measured, the economy was churning out astonishing growth. Yet it was poisoning the air, the water and, not infrequently, China’s own citizens.

None of that analysis was wrong. The conclusion, however, that the inherent stresses would lead to social chaos and bring the system crashing down was born of wishful thinking.

It underestimated the Communist party’s achievements in bringing tangible improvements to the lives of hundreds of millions of people. It underestimated, too, the strength of its patriotic message: that, after more than 100 years of humiliation, China had, finally, in the words of Mao Zedong, “stood up”.

Instead of collapsing, by some measures China has gone from strength to strength. Its output is more than twice the size of Japan’s. In purchasing-power parity terms, it overtook the US last year, making it the world’s biggest economy. In just 15 years, its gross domestic product per capita has jumped from 8 per cent of the US level to 25 per cent.

In Japan, many secretly hope that China will fail. Not without reason, they fear a vengeful, powerful neighbour with history book in hand. Yet in America and Europe, too, some have been guilty of assuming it is a house of cards.

Books with titles such as The Coming Collapse of China have been staples for years. It is possible to point out the flaws and gross injustices of the authoritarian system without predicting its imminent demise. At some point, the Communist party will yield to something else. All dynasties fail. Yet in all likelihood it will stay in power longer than many expect.

China’s rise is the most important event of our epoch. In the minds of many westerners, it is overshadowed by the threat of terrorism and by a technological revolution bearing the binary gifts of opportunity and destruction. Yet the consequences of the rejuvenation of a nation containing one-fifth of the world’s people will be profound, drawing the globe’s centre of gravity from west to east.

Economically, it has already transformed the prospects of raw-material producers from Angola to Australia, notwithstanding the recent fall in commodity prices born of China’s slowdown.

Politically, it has changed the calculations of almost every nation. The US has pivoted to Asia even as its diplomats ponder the continued feasibility of unconditional security guarantees with the likes of Japan and Taiwan. Drawn by the magnet of business and power, the UK has defied Washington by joining a Chinese bank designed to challenge a postwar order epitomised by the Bretton Woods institutions.China has shown that Japan’s success can be emulated, if not yet matched, on a much larger scale.

There are risks to China’s rise. Two stand out. The first is war. Humanity’s record in adjusting to rising powers is not good. As it grows stronger, Beijing will not accept Pax Americana, at least in what it considers to be its natural sphere of influence. Sino-US posturing around artificial islands in the South China Sea is a sign of things to come. So are bouts of angry nationalism aimed at Japan.

The second is environmental. Understandably, Chinese people aspire to US living standards, with American-sized cars and fridges. So do 1.3bn Indians, and hundreds of millions more in Asia, Africa and Latin America. It is not clear the planet can sustain such ambitions. Without significant technological breakthroughs, plausible but hardly preordained, something might have to give. That brings us back to conflict.For all the risks, China’s rise should be celebrated. Postwar Japan proved to the world that prosperity and modernity were not the preserve of white Europeans and Americans. China has shown that Japan’s success can be emulated, if not yet matched, on a much larger scale.

This might seem an odd time to celebrate. Is the Chinese model not coming apart at the seams? Growth has fallen more quickly than many had imagined. It could slow much further still. That could precipitate a financial crisis. Debt has doubled since 2009. It was not hard to paper over cracks in the system with double-digit growth. At 3 per cent, it might not be so easy.

Even if it avoids outright crisis, China may simply get stuck. Its labour force is shrinking. Its population is ageing rapidly . In just 15 years, nearly a quarter of its people will be over 65. Don’t the doomsayers now look like soothsayers?

In truth, China does not have to do that well to change the world. Because of the scale of its population, if its people attain only half the living standard of the US, its economy would be twice the size.

The Rise and Fall of Great Powers, by Professor Paul Kennedy of Yale University, suggests that military and diplomatic power will follow. Those seeking fissures in the system will find them aplenty. Those imagining that “the China threat” is about to disappear will be disappointed.

The consequences of the rejuvenation of a nation containing one-fifth of the world’s people will be profound, drawing the globe’s centre of gravity from west to east.'

World's largest economies GDP

Celebrate the rise of flawed, febrile China.For all the risks, we should celebrate its rise to the world’s second-largest economy.It is easy to imagine China’s economic freight train going off the rails. When I came to Asia 14 years ago, many people in Japan, where the economy was then three times the size of China’s in nominal terms, were predicting precisely that. Surely, they reasoned, the system must crumble under its own contradictions.

It was, after all, a state-managed economy prone to misallocation of capital and dependent on wasteful investment. It had a repressive political apparatus that spent more on internal security than on national defence.

Anger was growing at Communist party officials, many of whom were neck deep in corruption and engaged in land grabbing on an epic scale. Crudely measured, the economy was churning out astonishing growth. Yet it was poisoning the air, the water and, not infrequently, China’s own citizens.

None of that analysis was wrong. The conclusion, however, that the inherent stresses would lead to social chaos and bring the system crashing down was born of wishful thinking.

It underestimated the Communist party’s achievements in bringing tangible improvements to the lives of hundreds of millions of people. It underestimated, too, the strength of its patriotic message: that, after more than 100 years of humiliation, China had, finally, in the words of Mao Zedong, “stood up”.

Instead of collapsing, by some measures China has gone from strength to strength. Its output is more than twice the size of Japan’s. In purchasing-power parity terms, it overtook the US last year, making it the world’s biggest economy. In just 15 years, its gross domestic product per capita has jumped from 8 per cent of the US level to 25 per cent.

In Japan, many secretly hope that China will fail. Not without reason, they fear a vengeful, powerful neighbour with history book in hand. Yet in America and Europe, too, some have been guilty of assuming it is a house of cards.

Books with titles such as The Coming Collapse of China have been staples for years. It is possible to point out the flaws and gross injustices of the authoritarian system without predicting its imminent demise. At some point, the Communist party will yield to something else. All dynasties fail. Yet in all likelihood it will stay in power longer than many expect.

China’s rise is the most important event of our epoch. In the minds of many westerners, it is overshadowed by the threat of terrorism and by a technological revolution bearing the binary gifts of opportunity and destruction. Yet the consequences of the rejuvenation of a nation containing one-fifth of the world’s people will be profound, drawing the globe’s centre of gravity from west to east.

Economically, it has already transformed the prospects of raw-material producers from Angola to Australia, notwithstanding the recent fall in commodity prices born of China’s slowdown.

Politically, it has changed the calculations of almost every nation. The US has pivoted to Asia even as its diplomats ponder the continued feasibility of unconditional security guarantees with the likes of Japan and Taiwan. Drawn by the magnet of business and power, the UK has defied Washington by joining a Chinese bank designed to challenge a postwar order epitomised by the Bretton Woods institutions.China has shown that Japan’s success can be emulated, if not yet matched, on a much larger scale.

There are risks to China’s rise. Two stand out. The first is war. Humanity’s record in adjusting to rising powers is not good. As it grows stronger, Beijing will not accept Pax Americana, at least in what it considers to be its natural sphere of influence. Sino-US posturing around artificial islands in the South China Sea is a sign of things to come. So are bouts of angry nationalism aimed at Japan.

The second is environmental. Understandably, Chinese people aspire to US living standards, with American-sized cars and fridges. So do 1.3bn Indians, and hundreds of millions more in Asia, Africa and Latin America. It is not clear the planet can sustain such ambitions. Without significant technological breakthroughs, plausible but hardly preordained, something might have to give. That brings us back to conflict.For all the risks, China’s rise should be celebrated. Postwar Japan proved to the world that prosperity and modernity were not the preserve of white Europeans and Americans. China has shown that Japan’s success can be emulated, if not yet matched, on a much larger scale.

This might seem an odd time to celebrate. Is the Chinese model not coming apart at the seams? Growth has fallen more quickly than many had imagined. It could slow much further still. That could precipitate a financial crisis. Debt has doubled since 2009. It was not hard to paper over cracks in the system with double-digit growth. At 3 per cent, it might not be so easy.

Even if it avoids outright crisis, China may simply get stuck. Its labour force is shrinking. Its population is ageing rapidly . In just 15 years, nearly a quarter of its people will be over 65. Don’t the doomsayers now look like soothsayers?

In truth, China does not have to do that well to change the world. Because of the scale of its population, if its people attain only half the living standard of the US, its economy would be twice the size.

The Rise and Fall of Great Powers, by Professor Paul Kennedy of Yale University, suggests that military and diplomatic power will follow. Those seeking fissures in the system will find them aplenty. Those imagining that “the China threat” is about to disappear will be disappointed.

The consequences of the rejuvenation of a nation containing one-fifth of the world’s people will be profound, drawing the globe’s centre of gravity from west to east.'

World's largest economies GDP

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°56

Re: Economy of China:

Re: Economy of China:

China stock market outperforms S&P despite wild swings

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°57

Re: Economy of China:

Re: Economy of China:

Yuan reserves set to rise by $500 billion over 5 years

U.S. runs out of investor visas again as Chinese flood program

U.S. runs out of investor visas again as Chinese flood program

George1- Posts : 18486

Points : 18987

Join date : 2011-12-22

Location : Greece

- Post n°58

Re: Economy of China:

Re: Economy of China:

China’s yuan weakest since May 2011

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°59

Re: Economy of China:

Re: Economy of China:

China is expected to surpass the US in terms of nominal GDP by 2026

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°60

Re: Economy of China:

Re: Economy of China:

max steel wrote:China is expected to surpass the US in terms of nominal GDP by 2026

Far earlier...China still has an anemic internal demand in absolute terms. Much of the money the Chinese have is still going into housing and big projects. When that will go back to intermediate goals and consumption, China will leverage far quicker than the US. It's just a matter of numbers.

If by 2020 the gap is around a trillion, it will be basically a dead horse for the US.

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°61

Re: Economy of China:

Re: Economy of China:

KoTeMoRe wrote:max steel wrote:China is expected to surpass the US in terms of nominal GDP by 2026

Far earlier...China still has an anemic internal demand in absolute terms. Much of the money the Chinese have is still going into housing and big projects. When that will go back to intermediate goals and consumption, China will leverage far quicker than the US. It's just a matter of numbers.

If by 2020 the gap is around a trillion, it will be basically a dead horse for the US.

If you look at current figure difference between their GDPs is only 6.9 Trillion.

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°62

Re: Economy of China:

Re: Economy of China:

max steel wrote:KoTeMoRe wrote:max steel wrote:China is expected to surpass the US in terms of nominal GDP by 2026

Far earlier...China still has an anemic internal demand in absolute terms. Much of the money the Chinese have is still going into housing and big projects. When that will go back to intermediate goals and consumption, China will leverage far quicker than the US. It's just a matter of numbers.

If by 2020 the gap is around a trillion, it will be basically a dead horse for the US.

If you look at current figure difference between their GDPs is only 6.9 Trillion.

Yes but that's about half a decade worth, not over a decade. China is growing a trillion more in net terms and about 1.4 trillions brutto over the US. Clearly there's a questionmark about both numbers and sustainability when it comes to China, but if thy can keep it up, we would have new overlords at the dawn of the new decade.

So NO BI, you can't flogg a dead horse and hope it will run. Thanks for playing though.

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°63

Re: Economy of China:

Re: Economy of China:

China's non-financial FDI set to hit a record $126 billion in 2015

George1- Posts : 18486

Points : 18987

Join date : 2011-12-22

Location : Greece

- Post n°64

Re: Economy of China:

Re: Economy of China:

First Chinese Train Arrives to Russia as Part of New Silk Road

Read more: http://sputniknews.com/business/20160206/1034346323/china-russia-new-silk-road.html#ixzz3zPpA0ceB

Read more: http://sputniknews.com/business/20160206/1034346323/china-russia-new-silk-road.html#ixzz3zPpA0ceB

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°65

Re: Economy of China:

Re: Economy of China:

TPP Benefiting China

George1- Posts : 18486

Points : 18987

Join date : 2011-12-22

Location : Greece

- Post n°66

Re: Economy of China:

Re: Economy of China:

China’s Central Bank Strengthens Yuan-Dollar Rate by 0.3%

The People’s Bank of China (PBOC) set its national currency, the yuan, at 0.3 percent against the US dollar opening the market after extended Chinese Lunar New Year holidays on Monday.

BEIJING (Sputnik) – The PBOC fixed the average yuan exchange rate at 6.5118, marking the biggest rise in over three months, against the pre-holiday February 5 rate of 6.5314.

China's currency has lost more than 1.5 percent against the US dollar since the start of 2016.

The yuan's January devaluation by PBC has been the largest since August 2015, when the currency lost over 3 percent against the dollar, triggering a stock market slump around the world.

Decelerating growth rates have plagued the Chinese economy alongside turbulent stock markets and a falling currency. China's economy grew 6.9 percent in 2015, down from 7.3

Read more: http://sputniknews.com/asia/20160215/1034760719/yan-dollar-rate-strengthened.html#ixzz40EHMG12D

The People’s Bank of China (PBOC) set its national currency, the yuan, at 0.3 percent against the US dollar opening the market after extended Chinese Lunar New Year holidays on Monday.

BEIJING (Sputnik) – The PBOC fixed the average yuan exchange rate at 6.5118, marking the biggest rise in over three months, against the pre-holiday February 5 rate of 6.5314.

China's currency has lost more than 1.5 percent against the US dollar since the start of 2016.

The yuan's January devaluation by PBC has been the largest since August 2015, when the currency lost over 3 percent against the dollar, triggering a stock market slump around the world.

Decelerating growth rates have plagued the Chinese economy alongside turbulent stock markets and a falling currency. China's economy grew 6.9 percent in 2015, down from 7.3

Read more: http://sputniknews.com/asia/20160215/1034760719/yan-dollar-rate-strengthened.html#ixzz40EHMG12D

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°67

China's "Silk Road" Economic Belt

China's "Silk Road" Economic Belt

How China Is Building the Biggest Commercial-Military Empire in History

In the 18th and 19th centuries, the sun famously never set on the British empire. A commanding navy enforced its will, yet all would have been lost if it were not for ports, roads, and railroads. The infrastructure that the British built everywhere they went embedded and enabled their power like bones and veins in a body.

Great nations have done this since Rome paved 55,000 miles (89,000 km) of roads and aqueducts in Europe. In the 19th and 20th centuries, Russia and the United States established their own imprint, skewering and taming nearby territories with projects like the Trans-Siberian and the Trans-Continental railways.

Now it’s the turn of the Chinese. Much has been made of Beijing’s “resource grab” in Africa and elsewhere, its construction of militarized artificial islands in the South China Sea and, most recently, its new strategy to project naval power broadly in the open seas.

Yet these profiles of an allegedly grasping and treacherous China tend to consider its ambitions in disconnected pieces. What these pieces add up to is a whole latticework of infrastructure materializing around the world. Combined with the ambitious activities of Chinese companies, they are quickly growing into history’s most extensive global commercial empire.

China views almost no place as uncontested. Chinese-financed and -built dams, roads, railroads, natural gas pipelines, ports, and airports are either in place or will be from Samoa to Rio de Janeiro, St. Petersburg to Jakarta, Mombasa to Vanuatu, and from the Arctic to Antarctica. Many are built in service of current and prospective mines, oilfields, and other businesses back to China, and at times to markets abroad.

But while this grand picture suggests a deliberate plan devised in Beijing, it also reflects an unbridled commercial frenzy. Chinese companies are venturing out and doing deals lacking any particular order. Mostly, they’re interested in finding growth abroad that is proving difficult to manage at home. This, too, is typical for a fast-growing power.

“This is very much in line with what we would expect from other great powers whose military posture follows its economic and diplomatic footprint,” Lyle Morris, a China specialist with Rand, told Quartz.

Below are snapshots of components that are either already in place or on the way.

The story starts with a reimagined Silk Road

In September 2013, newly anointed Chinese leader Xi Jinping visited Kazakhstan’s capital, Astana. He was in town to seal the Chinese purchase of a $5 billion stake in Kashagan, one of the world’s largest oilfields. On that trip, he unveiled a plan ultimately dubbed “One Belt, One Road”—a land-and-sea version of the fabled East-West Silk Road trading route.

The idea is audacious in scope.

On land, Beijing has in mind a high-speed rail network (map 2). It will start in Kunming, the capital of Yunnan province, and connect with Laos and on into Cambodia, Malaysia, Myanmar, Singapore, Thailand and Vietnam.

Another overland network of roads, rail and energy pipelines will begin in Xi’an in central China and head west as far as Belgium (see dotted brown line above). As we’ve written previously, Beijing has already initiated an 8,011-mile cargo rail route between the Chinese city of Yiwu and Madrid, Spain. Finally, another 1,125-mile-long bullet train will start in Kashgar and punch south through Pakistan to the Arabian Sea port of Gwadur. The thinking behind this rail-driven plan isn’t new–as we have written previously, Beijing has been piecing it together for awhile.

At sea, a companion 21st-century Maritime Silk Road (see dotted blue line in map 1) would connect the South China Sea, and the Indian and South Pacific oceans. China would begin to protect its own sea lanes as well. On May 26 it disclosed a strategy for expanding its navy into a fleet that not only hugs its own shores, but can wander the open ocean.

China does not need to build all of these thousands of miles of railroads and other facilities. Much of the infrastructure already exists; where it does, the trick is to link it all together.

Everywhere, new public works will be required. And to make its vision materialize, Beijing must be careful to be seen as generously sharing the big engineering and construction projects. Up to now, such contracts have been treated as rare, big profit opportunities for state-owned Chinese industrial units. These include the China Railway Group, whose already-inflated share prices have often gone up each time another piece of the overseas empire has fallen into place. If local infrastructure companies are excluded from the largesse, there will be push-back on almost every continent.

In any case, not all this will necessarily happen. In a recent note to clients, China observer Jonathan Fenby of the research firm Trusted Sources suggested that it may all be too ambitious. China has had a history of announcing and then shelving projects, such as a $3.7 billion railway canceled by Mexico in February amid allegations of local nepotism. Meanwhile, Japan has begun to challenge Chinese plans. It has launched rival bids for billion-dollar high-speed rail and other projects in Indonesia, Thailand and elsewhere, with relatively low-interest loans and sometimes better technology (paywall).

But Beijing seems to recognize its own limits. Rather, the world may help to build at least some of the infrastructure through another Chinese creation—the Asian Infrastructure Investment Bank, with its 57 founding members, modeled loosely on the World Bank. Projects backed by the bank are meant to be good for the country where they are built. But given China’s outsize influence in the institution, they are certain to include some that fit into its grand scheme of global infrastructure.

extends into South America

Xi has pledged $250 billion in investment in South America over the next 10 years. The centerpiece is a $10 billion, 3,300-mile, high-speed railroad (dotted red line above) that would start in Acu, near Rio de Janeiro, crossing the Amazon rainforest and the Andes Mountains, and terminate on the Peruvian coast. (NPR’s Tom Ashbrook conducted anexcellent hour-long program on the railroad.)

On top of that, there’s an advanced proposal by Chinese billionaire Wang Jing to build a 170-mile-long, $50 billion canal through Nicaragua.

and also across Africa

In January, China agreed with the African Union to help build railroads (map 4), roads, and airports to link all 54 African countries. These plans are already under way, including a $13 billion, 875-mile-long coastal railroad in Nigeria; a $3.8 billion, 500-mile-long railroad connecting the Kenyan cities of Nairobi and Mombasa; a $4 billion, 460-mile railway linking the Ethiopian cities of Addis Ababa and Djibouti; and a $5.6 billion, 850-mile network of rail lines in Chad.

Then there are China’s maritime ambitions. These envision modern ports in the Tanzanian capital, Dar es Salaam; the Mozambican capital, Maputo; Libreville, Gabon; the Ghanaian city of Tema; and the Senegalese capital, Dakar.

All these land and marine projects align with existing Chinese natural-resource investments on the continent. For example, the China National Petroleum Corporation (CNPC) has large oil projects in Chadand Mozambique, and Chinese manufacturers are fast setting upEthiopian factories that rely on cheap local labor.

The new Chinese empire is enveloping its neighbors

In addition to its planned high-speed rail network into Malaysia and Singapore (map 2) and Laos (map 5) into southeast Asia (see map 5 for Laotian portion), China plans a canal across the Isthmus of Kra in Thailand, a deep-water container port and industrial park in Kuantan, Malaysia, and a $511-million expansionof Male airport in the Maldives.

and nations further afield in the Pacific

China wants to dominate not only the South and East China seas, but far into the Pacific (map 6). According to the Lowly Institute, transportation comprises by far the largest portion of $2.5 billion in Chinese assistance and commercial credit to South Sea nations. Among the projects are:

Fiji: A $158 million hydroelectric plant and several sports complexes, including the 4,000-seat Vodafone stadium in Suva.

Samoa: A $100 million hospital in Apia, a $40 million terminal and upgraded runway at Faleolo Airport, and a $140 million wharf at Vaiusu.

Tonga: A $12 million government building to be called St. George Palace, and two small Chinese turboprop aircraft for domestic routes aboard Real Tonga airlines. The aircraft deal has been controversial because neither of the planes are certified for use in the West.

Vanuatu: Two more turboprops, this time for Air Vanuatu, and $60 million to build a Port Vila campus of the University of the South Pacific and a Parliament House (both loans have been forgiven).

Pakistan is pivotal to China’s Silk Road

Why has China lavished $42 billion in infrastructure projects on Pakistan? The two have always been allies. But China has a particular goal: It wants to contain Uighur separatists who have been fomenting violence in the western province of Xinjiang. Some of these separatists have sanctuaries in Pakistan and Afghanistan, and Beijing has pushed hard for both countries to hand over Uighurs living there.

But sending goods through Pakistan (map 7) also helps China avoid the Malacca Strait (map . Much of Beijing’s oil and other natural resources passes through this narrow, 500-mile-long stretch of sea between Malaysia and Indonesia. China worries that, if its relations with Washington become truly hostile, the US could theoretically blockade the strait and starve the country of its lifeblood resources. That is in large part why Beijing is financing a deep Arabian Sea port at Gwadur, and the 1,125-mile-long super-highway, high-speed railway and oil-pipeline route to the Chinese city of Kashgar.

. Much of Beijing’s oil and other natural resources passes through this narrow, 500-mile-long stretch of sea between Malaysia and Indonesia. China worries that, if its relations with Washington become truly hostile, the US could theoretically blockade the strait and starve the country of its lifeblood resources. That is in large part why Beijing is financing a deep Arabian Sea port at Gwadur, and the 1,125-mile-long super-highway, high-speed railway and oil-pipeline route to the Chinese city of Kashgar.

as is Central Asia

Central Asia has been an almost exclusively Russian playground for almost two centuries. It still is when it comes to pure muscle. But in matters of cash, China is fast moving in.

The relationship revolves around oil and natural gas. Turkmenistansupplies more than half of China’s imported gas. It gets there throughthree, 1,150-mile-long pipelines; a fourth pipeline is soon to begin construction. China is the only foreign nation that Turkmenistan allows to drill for gas onshore, in particular from Galkynysh, the second-largest gasfield in the world. China’s $5 billion share of the Kashagan oilfield in Kazakhstan is one of its largest oil stakes anywhere. Xi also has signed $15 billion in gas and uranium deals inUzbekistan.

and Russia

Two years ago, Russia announced a pivot towards China. The centerpiece of the shift is two natural-gas pipelines (the larger of the two is the dotted red line in map 9) through which a fifth of China’s gas imports would flow. The deal had some snags, but they reportedly have been worked out, and construction is to begin soon. In addition, China is to build a $242 billion, 4,300-mile high-speed railway from Beijing to Moscow, a two-day trip compared with the current six-day Trans-Mongolian Express.

China is speeding up how fast goods get to Europe

The Maritime Silk Road (the solid blue line in map 10) will enter Europe through a $260 million Chinese-funded upgrade of the Greek port of Piraeus. From there, rail service will continue into the Balkans. Ships from China will also make port in Lisbon, Portugal, and Duisburg, Germany. To take the network into the heart of Europe, Beijing has agreed to finance a 250-mile bullet train, costing up to $3 billion, from Belgrade to Budapest. Separately, China’s new 8,011-mile cargo railroadfrom Yiwu to Madrid is taking away business from far more time-consuming truck shipping.

and has piled into US real estate

For now, the Chinese web of infrastructure does not extend to the US. Instead, what has been built elsewhere is serving as a jumping-off point to the gigantic US market. High-speed trains are only now starting to be planned in the US, and Chinese firms are front-runners to win contracts, including a $1 billion contest for the San Francisco-to-Los Angeles route, expected to be worth $68 billion. China’s CNR Corp. is already providing 284 passenger cars worth $566 million to the Boston subway system.

Another big splash: the United States is China’s favored destination for real estate investment (see chart above). This has included commercial jewels such as New York’s Waldorf Astoria ($1.95 billion to Angbang Insurance) and the Chase Manhattan Plaza ($725 million to Fosun). But the bigger sums have been spent in all-cash deals by wealthy Chinesefor residential properties.

Last but not least, China has polar ambitions

Though the closest Chinese territory gets to the Arctic Circle is a thousand miles away, China nonetheless calls itself a “near-Arctic state.” Chinese oil company Cnooc has a majority share in Iceland’s Dreki oil and natural gas field, and Beijing established the Arctic Yellow River Station, a permanent research facility on Norway’s Spitsbergen Island. In Antarctica, China has four research stations, structures that allow nations to stake a claim to the continent. Plans for a fifth station at a place called Inexpressible Island are under way. It is positioning itself to move for the continent’s resources when a 1959 treaty guaranteeing its wilderness status expires in 2048.

Some of the infrastructure China is creating around the world will align with Western economic interests. But to the extent that it does, that will be inadvertent. Some of the most modern transportation infrastructure going up not only in China, but around the developing world, is deliberately linked to China. It is meant to make the global economy a friendly place for Chinese commerce.

That does not make China’s ambitions necessarily menacing or pernicious. But it does make them China-centric. It’s worth remembering that this way of doing economic development is not a Chinese invention. As Michael Pillsbury, author of “The Hundred Year Marathon,” tells Quartz, China’s ambitions are rooted in “a fierce sense of competitiveness which they claim they learned from the America of the 1800s.”

In the 18th and 19th centuries, the sun famously never set on the British empire. A commanding navy enforced its will, yet all would have been lost if it were not for ports, roads, and railroads. The infrastructure that the British built everywhere they went embedded and enabled their power like bones and veins in a body.

Great nations have done this since Rome paved 55,000 miles (89,000 km) of roads and aqueducts in Europe. In the 19th and 20th centuries, Russia and the United States established their own imprint, skewering and taming nearby territories with projects like the Trans-Siberian and the Trans-Continental railways.

Now it’s the turn of the Chinese. Much has been made of Beijing’s “resource grab” in Africa and elsewhere, its construction of militarized artificial islands in the South China Sea and, most recently, its new strategy to project naval power broadly in the open seas.

Yet these profiles of an allegedly grasping and treacherous China tend to consider its ambitions in disconnected pieces. What these pieces add up to is a whole latticework of infrastructure materializing around the world. Combined with the ambitious activities of Chinese companies, they are quickly growing into history’s most extensive global commercial empire.

China views almost no place as uncontested. Chinese-financed and -built dams, roads, railroads, natural gas pipelines, ports, and airports are either in place or will be from Samoa to Rio de Janeiro, St. Petersburg to Jakarta, Mombasa to Vanuatu, and from the Arctic to Antarctica. Many are built in service of current and prospective mines, oilfields, and other businesses back to China, and at times to markets abroad.

But while this grand picture suggests a deliberate plan devised in Beijing, it also reflects an unbridled commercial frenzy. Chinese companies are venturing out and doing deals lacking any particular order. Mostly, they’re interested in finding growth abroad that is proving difficult to manage at home. This, too, is typical for a fast-growing power.

“This is very much in line with what we would expect from other great powers whose military posture follows its economic and diplomatic footprint,” Lyle Morris, a China specialist with Rand, told Quartz.

Below are snapshots of components that are either already in place or on the way.

The story starts with a reimagined Silk Road

In September 2013, newly anointed Chinese leader Xi Jinping visited Kazakhstan’s capital, Astana. He was in town to seal the Chinese purchase of a $5 billion stake in Kashagan, one of the world’s largest oilfields. On that trip, he unveiled a plan ultimately dubbed “One Belt, One Road”—a land-and-sea version of the fabled East-West Silk Road trading route.

The idea is audacious in scope.

On land, Beijing has in mind a high-speed rail network (map 2). It will start in Kunming, the capital of Yunnan province, and connect with Laos and on into Cambodia, Malaysia, Myanmar, Singapore, Thailand and Vietnam.

Another overland network of roads, rail and energy pipelines will begin in Xi’an in central China and head west as far as Belgium (see dotted brown line above). As we’ve written previously, Beijing has already initiated an 8,011-mile cargo rail route between the Chinese city of Yiwu and Madrid, Spain. Finally, another 1,125-mile-long bullet train will start in Kashgar and punch south through Pakistan to the Arabian Sea port of Gwadur. The thinking behind this rail-driven plan isn’t new–as we have written previously, Beijing has been piecing it together for awhile.

At sea, a companion 21st-century Maritime Silk Road (see dotted blue line in map 1) would connect the South China Sea, and the Indian and South Pacific oceans. China would begin to protect its own sea lanes as well. On May 26 it disclosed a strategy for expanding its navy into a fleet that not only hugs its own shores, but can wander the open ocean.

China does not need to build all of these thousands of miles of railroads and other facilities. Much of the infrastructure already exists; where it does, the trick is to link it all together.

Everywhere, new public works will be required. And to make its vision materialize, Beijing must be careful to be seen as generously sharing the big engineering and construction projects. Up to now, such contracts have been treated as rare, big profit opportunities for state-owned Chinese industrial units. These include the China Railway Group, whose already-inflated share prices have often gone up each time another piece of the overseas empire has fallen into place. If local infrastructure companies are excluded from the largesse, there will be push-back on almost every continent.

In any case, not all this will necessarily happen. In a recent note to clients, China observer Jonathan Fenby of the research firm Trusted Sources suggested that it may all be too ambitious. China has had a history of announcing and then shelving projects, such as a $3.7 billion railway canceled by Mexico in February amid allegations of local nepotism. Meanwhile, Japan has begun to challenge Chinese plans. It has launched rival bids for billion-dollar high-speed rail and other projects in Indonesia, Thailand and elsewhere, with relatively low-interest loans and sometimes better technology (paywall).

But Beijing seems to recognize its own limits. Rather, the world may help to build at least some of the infrastructure through another Chinese creation—the Asian Infrastructure Investment Bank, with its 57 founding members, modeled loosely on the World Bank. Projects backed by the bank are meant to be good for the country where they are built. But given China’s outsize influence in the institution, they are certain to include some that fit into its grand scheme of global infrastructure.

extends into South America

Xi has pledged $250 billion in investment in South America over the next 10 years. The centerpiece is a $10 billion, 3,300-mile, high-speed railroad (dotted red line above) that would start in Acu, near Rio de Janeiro, crossing the Amazon rainforest and the Andes Mountains, and terminate on the Peruvian coast. (NPR’s Tom Ashbrook conducted anexcellent hour-long program on the railroad.)

On top of that, there’s an advanced proposal by Chinese billionaire Wang Jing to build a 170-mile-long, $50 billion canal through Nicaragua.

and also across Africa

In January, China agreed with the African Union to help build railroads (map 4), roads, and airports to link all 54 African countries. These plans are already under way, including a $13 billion, 875-mile-long coastal railroad in Nigeria; a $3.8 billion, 500-mile-long railroad connecting the Kenyan cities of Nairobi and Mombasa; a $4 billion, 460-mile railway linking the Ethiopian cities of Addis Ababa and Djibouti; and a $5.6 billion, 850-mile network of rail lines in Chad.

Then there are China’s maritime ambitions. These envision modern ports in the Tanzanian capital, Dar es Salaam; the Mozambican capital, Maputo; Libreville, Gabon; the Ghanaian city of Tema; and the Senegalese capital, Dakar.

All these land and marine projects align with existing Chinese natural-resource investments on the continent. For example, the China National Petroleum Corporation (CNPC) has large oil projects in Chadand Mozambique, and Chinese manufacturers are fast setting upEthiopian factories that rely on cheap local labor.

The new Chinese empire is enveloping its neighbors

In addition to its planned high-speed rail network into Malaysia and Singapore (map 2) and Laos (map 5) into southeast Asia (see map 5 for Laotian portion), China plans a canal across the Isthmus of Kra in Thailand, a deep-water container port and industrial park in Kuantan, Malaysia, and a $511-million expansionof Male airport in the Maldives.

and nations further afield in the Pacific

China wants to dominate not only the South and East China seas, but far into the Pacific (map 6). According to the Lowly Institute, transportation comprises by far the largest portion of $2.5 billion in Chinese assistance and commercial credit to South Sea nations. Among the projects are:

Fiji: A $158 million hydroelectric plant and several sports complexes, including the 4,000-seat Vodafone stadium in Suva.

Samoa: A $100 million hospital in Apia, a $40 million terminal and upgraded runway at Faleolo Airport, and a $140 million wharf at Vaiusu.

Tonga: A $12 million government building to be called St. George Palace, and two small Chinese turboprop aircraft for domestic routes aboard Real Tonga airlines. The aircraft deal has been controversial because neither of the planes are certified for use in the West.

Vanuatu: Two more turboprops, this time for Air Vanuatu, and $60 million to build a Port Vila campus of the University of the South Pacific and a Parliament House (both loans have been forgiven).

Pakistan is pivotal to China’s Silk Road

Why has China lavished $42 billion in infrastructure projects on Pakistan? The two have always been allies. But China has a particular goal: It wants to contain Uighur separatists who have been fomenting violence in the western province of Xinjiang. Some of these separatists have sanctuaries in Pakistan and Afghanistan, and Beijing has pushed hard for both countries to hand over Uighurs living there.

But sending goods through Pakistan (map 7) also helps China avoid the Malacca Strait (map

as is Central Asia

Central Asia has been an almost exclusively Russian playground for almost two centuries. It still is when it comes to pure muscle. But in matters of cash, China is fast moving in.

The relationship revolves around oil and natural gas. Turkmenistansupplies more than half of China’s imported gas. It gets there throughthree, 1,150-mile-long pipelines; a fourth pipeline is soon to begin construction. China is the only foreign nation that Turkmenistan allows to drill for gas onshore, in particular from Galkynysh, the second-largest gasfield in the world. China’s $5 billion share of the Kashagan oilfield in Kazakhstan is one of its largest oil stakes anywhere. Xi also has signed $15 billion in gas and uranium deals inUzbekistan.

and Russia

Two years ago, Russia announced a pivot towards China. The centerpiece of the shift is two natural-gas pipelines (the larger of the two is the dotted red line in map 9) through which a fifth of China’s gas imports would flow. The deal had some snags, but they reportedly have been worked out, and construction is to begin soon. In addition, China is to build a $242 billion, 4,300-mile high-speed railway from Beijing to Moscow, a two-day trip compared with the current six-day Trans-Mongolian Express.

China is speeding up how fast goods get to Europe

The Maritime Silk Road (the solid blue line in map 10) will enter Europe through a $260 million Chinese-funded upgrade of the Greek port of Piraeus. From there, rail service will continue into the Balkans. Ships from China will also make port in Lisbon, Portugal, and Duisburg, Germany. To take the network into the heart of Europe, Beijing has agreed to finance a 250-mile bullet train, costing up to $3 billion, from Belgrade to Budapest. Separately, China’s new 8,011-mile cargo railroadfrom Yiwu to Madrid is taking away business from far more time-consuming truck shipping.

and has piled into US real estate

For now, the Chinese web of infrastructure does not extend to the US. Instead, what has been built elsewhere is serving as a jumping-off point to the gigantic US market. High-speed trains are only now starting to be planned in the US, and Chinese firms are front-runners to win contracts, including a $1 billion contest for the San Francisco-to-Los Angeles route, expected to be worth $68 billion. China’s CNR Corp. is already providing 284 passenger cars worth $566 million to the Boston subway system.

Another big splash: the United States is China’s favored destination for real estate investment (see chart above). This has included commercial jewels such as New York’s Waldorf Astoria ($1.95 billion to Angbang Insurance) and the Chase Manhattan Plaza ($725 million to Fosun). But the bigger sums have been spent in all-cash deals by wealthy Chinesefor residential properties.

Last but not least, China has polar ambitions

Though the closest Chinese territory gets to the Arctic Circle is a thousand miles away, China nonetheless calls itself a “near-Arctic state.” Chinese oil company Cnooc has a majority share in Iceland’s Dreki oil and natural gas field, and Beijing established the Arctic Yellow River Station, a permanent research facility on Norway’s Spitsbergen Island. In Antarctica, China has four research stations, structures that allow nations to stake a claim to the continent. Plans for a fifth station at a place called Inexpressible Island are under way. It is positioning itself to move for the continent’s resources when a 1959 treaty guaranteeing its wilderness status expires in 2048.

Some of the infrastructure China is creating around the world will align with Western economic interests. But to the extent that it does, that will be inadvertent. Some of the most modern transportation infrastructure going up not only in China, but around the developing world, is deliberately linked to China. It is meant to make the global economy a friendly place for Chinese commerce.

That does not make China’s ambitions necessarily menacing or pernicious. But it does make them China-centric. It’s worth remembering that this way of doing economic development is not a Chinese invention. As Michael Pillsbury, author of “The Hundred Year Marathon,” tells Quartz, China’s ambitions are rooted in “a fierce sense of competitiveness which they claim they learned from the America of the 1800s.”

OminousSpudd- Posts : 942

Points : 947

Join date : 2015-01-02

Location : New Zealand

- Post n°68

Re: Economy of China:

Re: Economy of China:

Excellent analysis by Pepe Escobar on the new Silk Road project.

Regular- Posts : 3894

Points : 3868

Join date : 2013-03-10

Location : Ukrolovestan

- Post n°69

China's "Silk Road" Economic Belt

China's "Silk Road" Economic Belt

Was expecting something different when I've read Silk Road

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

- Post n°70

Re: Economy of China:

Re: Economy of China:

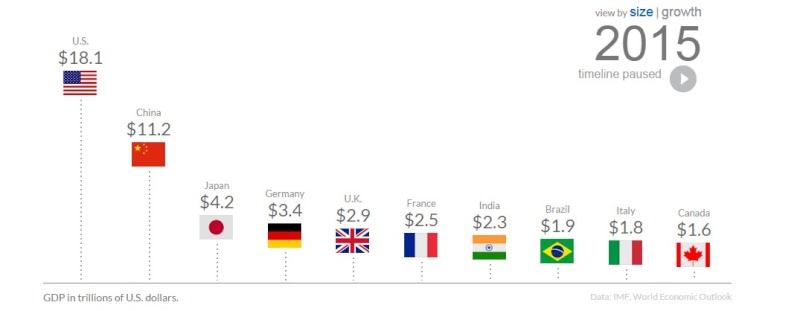

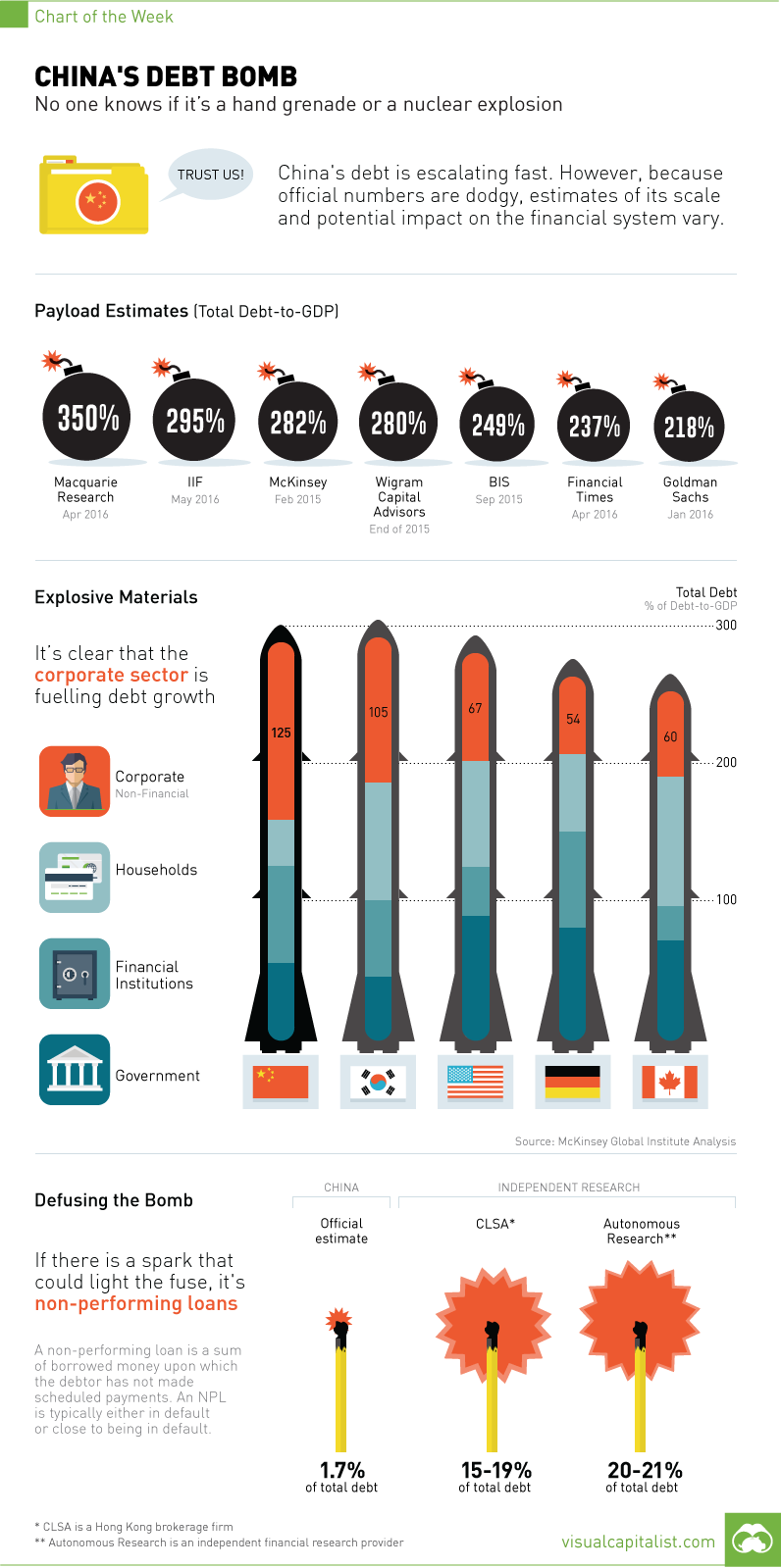

China's Debt Bomb: No One Really Knows The Payload

http://www.zerohedge.com/news/2016-05-17/chinas-debt-bomb-no-one-really-knows-payload

http://www.zerohedge.com/news/2016-05-17/chinas-debt-bomb-no-one-really-knows-payload

GunshipDemocracy- Posts : 6151

Points : 6171

Join date : 2015-05-17

Location : fishin on Stalin´s Strait between Mexico and Canada

- Post n°71

Re: Economy of China:

Re: Economy of China:

Austin wrote:China's Debt Bomb: No One Really Knows The Payload

http://www.zerohedge.com/news/2016-05-17/chinas-debt-bomb-no-one-really-knows-payload

hmm surely us agencies tell truth and only truth. Alas forgetting China still has $3,22 trillions foreign exange reserves. Dumping this to drain means collapse of us economy and likely total war.

http://www.tradingeconomics.com/china/foreign-exchange-reserves

BTW what base of gdp was taken to measure debt I did not find but might miss something.

us accumulated debt seems to be close to 70,000 trillions! they no way gonna pay it back. That´s why most of wars around world.

http://www.usdebtclock.org/

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

Austin wrote:China's Debt Bomb: No One Really Knows The Payload

Well for start NEVER read Zerohedge to know about China's Economy.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

Make a Good Read on 3 Part Series on Chinese Ponzi Economy by David Stockman

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 1

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 2

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 3

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 1

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 2

Red Ponzi Ticking—-China And The Dark Side Of The Global Bubble, Part 3

max steel- Posts : 2930

Points : 2955

Join date : 2015-02-12

Location : South Pole

- Post n°74

Re: Economy of China:

Re: Economy of China:

Why China could lead the next phase of globalization

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

- Post n°75

Re: Economy of China:

Re: Economy of China:

New 2025 Global Growth Projections Predict China’s Further Slowdown and the Continued Rise of India

http://atlas.cid.harvard.edu/rankings/growth-predictions/

http://atlas.cid.harvard.edu/rankings/growth-predictions/

|

|

|