World Economic News and Discussion

Werewolf- Posts : 5921

Points : 6110

Join date : 2012-10-24

- Post n°276

Re: World Economic News and Discussion

Re: World Economic News and Discussion

GarryB, flamming_python, Kiko, Broski and Belisarius like this post

GarryB- Posts : 39672

Points : 40168

Join date : 2010-03-30

Location : New Zealand

- Post n°277

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Belisarius likes this post

franco- Posts : 6796

Points : 6822

Join date : 2010-08-18

- Post n°278

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Western neoliberalism has languished. And they have no explanation other than crying, "But we have freedom and democracy."

The fake logic here is, of course, that somehow freedom and democracy prevent economic growth.

The real reasons behind the success of the China Model include but not limited to:

But all these go against Western-style system where incompetent politicians get elected and casino capitalism preys on the masses.

TOTAL GDP GROWTH 2000-2020 https://twitter.com/Kanthan2030/status/1650092861889851392/photo/1

Russia in 3rd spot (476%) behind China and Indonesia just ahead of India.

GarryB likes this post

franco- Posts : 6796

Points : 6822

Join date : 2010-08-18

- Post n°279

Re: World Economic News and Discussion

Re: World Economic News and Discussion

The "status as a reserve currency eroded in 2022 at 10 times the pace seen in the past two decades".

https://finance.yahoo.com/news/russia-iran-plan-gold-backed-100000752.html

GarryB and flamming_python like this post

GarryB- Posts : 39672

Points : 40168

Join date : 2010-03-30

Location : New Zealand

- Post n°280

Re: World Economic News and Discussion

Re: World Economic News and Discussion

The US dollar was the golden goose that laid the golden eggs that kept the US rich... and they have made goose soup... and it is bitter.

flamming_python and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°281

Re: World Economic News and Discussion

Re: World Economic News and Discussion

It is now established that the US dollar’s status as a global reserve currency is eroding. When corporate western media begins to attack the multipolar world’s de-dollarization narrative in earnest, you know the panic in Washington has fully set in.

The numbers: the dollar share of global reserves was 73 percent in 2001, 55 percent in 2021, and 47 percent in 2022. The key takeaway is that last year, the dollar share slid 10 times faster than the average in the past two decades.

Now it is no longer far-fetched to project a global dollar share of only 30 percent by the end of 2024, coinciding with the next US presidential election.

The defining moment – the actual trigger leading to the Fall of the Hegemon – was in February 2022, when over $300 billion in Russian foreign reserves were “frozen” by the collective west, and every other country on the planet began fearing for their own dollar stores abroad. There was some comic relief in this absurd move, though: the EU “can’t find” most of it.

Now cue to some current essential developments on the trading front.

Over 70 percent of trade deals between Russia and China now use either the ruble or the yuan, according to Russian Finance Minister Anton Siluanov.

Russia and India are trading oil in rupees. Less than four weeks ago, Banco Bocom BBM became the first Latin American bank to sign up as a direct participant of the Cross-Border Interbank Payment System (CIPS), which is the Chinese alternative to the western-led financial messaging system, SWIFT.

China’s CNOOC and France’s Total signed their first LNG trade in yuan via the Shanghai Petroleum and Natural Gas Exchange.

The deal between Russia and Bangladesh for the construction of the Rooppur nuclear plant will also bypass the US dollar. The first $300 million payment will be in yuan, but Russia will try to switch the next ones to rubles.

Russia and Bolivia’s bilateral trade now accepts settlements in Boliviano. That’s extremely pertinent, considering Rosatom’s drive to be a crucial part of the development of lithium deposits in Bolivia.

Notably, many of those trades involve BRICS countries – and beyond. At least 19 nations have already requested to join BRICS+, the extended version of the 21st century’s major multipolar institution, whose founding members are Brazil, Russia, India, and China, then South Africa. The foreign ministers of the original five will start discussing the modalities of accession for new members in an upcoming June summit in Capetown.

BRICS, as it stands, is already more relevant to the global economy than the G7. The latest IMF figures reveal that the existing five BRICS nations will contribute 32.1 percent to global growth, compared to the G7’s 29.9 percent.

With Iran, Saudi Arabia, UAE, Turkey, Indonesia, and Mexico as possible new members, it is clear that key Global South players are starting to focus on the quintessential multilateral institution capable of smashing Western hegemony.

Russian President Vladimir Putin and Saudi Crown Prince Mohammad bin Salman (MbS) are working in total sync as Moscow’s partnership with Riyadh in OPEC+ metastasizes into BRICS+, in parallel to the deepening Russia-Iran strategic partnership.

MbS has willfully steered Saudi Arabia toward Eurasia’s new power trio Russia-Iran-China (RIC), away from the US. The new game in West Asia is the incoming BRIICSS – featuring, remarkably, both Iran and Saudi Arabia, whose historic reconciliation was brokered by yet another BRICS heavyweight, China.

Importantly, the evolving Iran-Saudi rapprochement also implies a much closer relationship between the Gulf Cooperation Council (GCC) as a whole and the Russia-China strategic partnership.

This will translate into complementary roles – in terms of trade connectivity and payment systems – for the International North-South Transportation Corridor (INSTC), linking Russia-Iran-India, and the China-Central-Asia-West Asia Economic Corridor, a key plank of Beijing’s ambitious, multi-trillion-dollar Belt and Road Initiative (BRI).

Today, only Brazil, with its President Luiz Inácio Lula Da Silva caged by the Americans and an erratic foreign policy, runs the risk of being relegated by the BRICS to the status of a secondary player.

Beyond BRIICSS

The de-dollarization train has been propelled to high-speed status by the accumulated effects of Covid-linked supply chain chaos and collective western sanctions on Russia.

The essential point is this: The BRICS have the commodities, and the G7 controls finance. The latter can’t grow commodities, but the former can create currencies – especially when their value is linked to tangibles like gold, oil, minerals, and other natural resources.

Arguably the key swing factor is that pricing for oil and gold is already shifting to Russia, China, and West Asia.

In consequence, demand for dollar-denominated bonds is slowly but surely collapsing. Trillions of US dollars will inevitably start to go back home – shattering the dollar’s purchasing power and its exchange rate.

The fall of a weaponized currency will end up smashing the whole logic behind the US’ global network of 800+ military bases and their operating budgets.

Since mid-March, in Moscow, during the Economic Forum of the Commonwealth of Independent States (CSI) – one of the key inter-government organizations in Eurasia formed after the fall of the USSR – further integration is being actively discussed between the CSI, the Eurasia Economic Union (EAEU), the Shanghai Cooperation Organization (SCO) and the BRICS.

Eurasian organizations coordinating the counterpunch to the current western-led system, which tramples on international law, was not by accident one of the key themes of Russian Foreign Minister Sergey Lavrov’s speech at the UN earlier this week. It is also no accident that four member-states of the CIS – Russia and three Central Asian “stans” – founded the SCO along with China in June 2001.

The Davos/Great Reset globalist combo, for all practical purposes, declared war on oil immediately after the start of Russia’s Special Military Operation (SMO) in Ukraine. They threatened OPEC+ to isolate Russia – or else, but failed humiliatingly. OPEC+, effectively run by Moscow-Riyadh, now rules the global oil market.

Western elites are in a panic. Especially after Lula’s bombshell on Chinese soil during his visit with Xi Jinping, when he called on the whole Global South to replace the US dollar with their own currencies in international trade.

Christine Lagarde, president of the European Central Bank (ECB), recently told the New York-based Council of Foreign Relations – the heart of the US establishment matrix – that “geopolitical tensions between the US and China could raise inflation by 5 percent and threaten the dominance of the dollar and euro.”

The monolithic spin across western mainstream media is that BRICS economies trading normally with Russia “creates new problems for the rest of the world.” That’s utter nonsense: it only creates problems for the dollar and the euro.

The collective west is reaching Desperation Row – now timed with the astonishing announcement of a Biden-Harris US presidential ticket running again in 2024. This means that the US administration’s neo-con handlers will double down on their plan to unleash an industrial war against both Russia and China by 2025.

The petroyuan cometh

And that brings us back to de-dollarization and what will replace the hegemonic reserve currency of the world. Today, the GCC represents more than 25 percent of global oil exports (Saudi Arabia stands at 17 percent). More than 25 percent of China’s oil imports come from Riyadh. And China, predictably, is the GCC’s top trading partner.

The Shanghai Petroleum and Natural Gas Exchange went into business in March 2018. Any oil producer, from anywhere, can sell in Shanghai in yuan today. This means that the balance of power in the oil markets is already shifting from the US dollar to the yuan.

The catch is that most oil producers prefer not to keep large stashes of yuan; after all, everyone is still used to the petrodollar. Cue to Beijing linking crude futures in Shanghai to converting yuan into gold. And all that without touching China’s massive gold reserves.

This simple process happens via gold exchanges set up in Shanghai and Hong Kong. And not by accident, it lies at the heart of a new currency to bypass the dollar being discussed by the EAEU.

Dumping the dollar already has a mechanism: making full use of the Shanghai Energy Exchange’s future oil contracts in yuan. That’s the preferred path for the end of the petrodollar.

US global power projection is fundamentally based on controlling the global currency. Economic control underlies the Pentagon’s ‘Full Spectrum Dominance’ doctrine. Yet now, even military projection is in shambles, with Russia maintaining an unreachable advance on hypersonic missiles and Russia-China-Iran able to deploy an array of carrier-killers.

The Hegemon – clinging to a toxic cocktail of neoliberalism, sanction dementia, and widespread threats – is bleeding from within. De-dollarization is an inevitable response to system collapse. In a Sun Tzu 2.0 environment, it is no wonder the Russia-China strategic partnership exhibits no intention of interrupting the enemy when he is so busy defeating himself.

https://www.unz.com/pescobar/de-dollarization-kicks-into-high-gear/

GarryB, franco, ahmedfire, flamming_python and Broski like this post

AlfaT8- Posts : 2477

Points : 2468

Join date : 2013-02-02

- Post n°282

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Traders Aren't Buying The Oil Deficit Story

Traders are not buying the oil deficit story.

That’s the conclusion that forces itself based on the latest oil and fuel buying and selling developments ahead of the latest OPEC+ meeting.

The price movements that followed that meeting were proof that this attitude was correct.

The initial price jump that every production cut announcement from OPEC+ causes fizzled out less than a day after the announcement.

Over the past six weeks, institutional traders have reduced their positions in crude oil and fuels by 238 million barrels, Reuters’ John Kemp reported earlier this week, which was one of the lowest weekly positions in those contracts since 2013.

These six weeks were marked by some strongly bearish developments reinforcing the sentiment, such as weaker than expected Chinese economic index readings and the U.S. debt ceiling negotiations.

It appears that traders have focused entirely on those economic index readings instead of the fact that Chinese crude oil demand hit a record in April despite refineries shutting down for seasonal maintenance.

They also did not really acknowledge U.S. legislators’ success in passing the debt ceiling bill that averted a federal debt default, even though the uncertainty surrounding the issue was a major driver for bullish behavior on the oil market.

Perhaps this has something to do with news about a recession in the U.S. manufacturing and freight transport sectors, which has hurt oil consumption in these industries. It seems that institutional oil traders have been focusing almost exclusively on consumption lately.

It will not be good news for OPEC, however. The cartel cannot keep cutting deeper and deeper – at some point, this will start playing to the advantage of U.S. shale. In fact, according to some, it already is, with analysts predicting higher U.S. exports as Saudi Arabia trims production by another 1 million bpd.

https://www.zerohedge.com/markets/traders-arent-buying-oil-deficit-story

How real is this Shale threat from the U.S??

Could they even hope to compete with OPEC+?

As i see it, shale is still very expensive, and if the U.S cant export much of it since they need it for themselves.

Either way, the price is gonna go up.

Or am i missing something??

Whats the current state of the U.S shale industry?

GarryB- Posts : 39672

Points : 40168

Join date : 2010-03-30

Location : New Zealand

- Post n°283

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Essentially what they are saying is that if OPEC keeps cutting oil production then the US will start licking the inside of old used oil barrels to make up the difference... the investors promised those old barrels are almost still full when they know they are practically empty because they need investment or it simply does not work.

Sounds like the west saying it is OK Europe... if evil Russia cuts you off from gas and oil supplies then you can buy American gas and oil and you will be fine...

kvs- Posts : 15480

Points : 15617

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°284

Re: World Economic News and Discussion

Re: World Economic News and Discussion

are trapped regular oil reservoirs sandwiched between layers of shale-like low-porosity sedimentary rock. Shale only has kerogens

which require heat processing to "cook" into oil.

So we have the deliberate confounding of Bakken type reservoirs and Green River shale kerogens as if they are the same thing.

There is no commercial operation anywhere on the planet that is extracting and cooking shale kerogens into oil. Shell had a

test operation that ran from the 1970s until the 2010s that failed to come up with a commercially viable method of cooking

the kerogens in situ. They would drill a series of boreholes around the target zone and fill them with liquid nitrogen to create

and thermal barrier for the zone where an attempt was made to start a flame front in the shale itself. The idea was to

produce oil in the rock and drive it out using the same heat source. I do not have all the details but this process failed.

Estonia has a shale fossil fuel operation since the USSR period where shale is mined and crushed and then cooked in furnaces.

The heat creates and releases oil that burns and keeps the process going. As far as I know Estonia is only place where this

process works because of the particularly rich kerogen amount in the local shale.

The US reserves of hard-to-access oil in the Bakken and East Texas formations is very small compared to the touted trillion barrels

of "shale oil" in the Green River formation. When these clowns start to do something with the Green River formation, then they

should start yapping. For now it is not even a prospective development. It is masturbatory drivel.

GarryB, AlfaT8 and lancelot like this post

lancelot- Posts : 2872

Points : 2870

Join date : 2020-10-18

- Post n°285

Re: World Economic News and Discussion

Re: World Economic News and Discussion

https://oilprice.com/Energy/Energy-General/ExxonMobil-New-Fracking-Technology-Can-Double-Oil-Output.html

GarryB and kvs like this post

kvs- Posts : 15480

Points : 15617

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°286

Re: World Economic News and Discussion

Re: World Economic News and Discussion

lancelot wrote:The latest claim to fame seems to be refractruring.

https://oilprice.com/Energy/Energy-General/ExxonMobil-New-Fracking-Technology-Can-Double-Oil-Output.html

I scanned through this article an it is pure investor BS. The extraction from the rock layers trapped by tight rock follows the

same dynamics as with any other conventional reservoir. They make it sound like they are enhancing extraction via a new

fangled process. The only thing they could be doing is accessing more of the non-uniform conventional reservoir. The

oil comes out through internal reservoir pressure from both the weight of the overlying strata and gas that comes together

with the oil. This naturally depletes and water driving helps to extract more oil. But there is a fundamental limit at around

45% extraction when the regime transitions from an inverse emulsion (water in an oil matrix) to a regular emulsion (oil in a water

matrix). When this occurs the water flows but the oil stays in place. Nothing outside of mining and crushing the rock will extract

the remaining 55% of the oil and that ain't happening.

Fancy steel borehole lining with holes has nothing to do with any of this. Water driving is already pressurized.

GarryB and flamming_python like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°287

Re: World Economic News and Discussion

Re: World Economic News and Discussion

La Nación: Argentina used yuan instead of dollars to pay IMF debt.

BUENOS AIRES, July 1 - RIA Novosti. Argentina, amid problems with international reserves, paid off its debt to the IMF in yuan, writes the newspaper La Nación.

The government made a $2.7 billion payment today using yuan and special drawing rights.

An Argentine delegation is expected to travel to the United States next week to continue negotiations.

In June 2018, the IMF approved a $50 billion loan to Argentina. This was supposed to help reduce the budget deficit against the backdrop of soaring inflation. In October of that year, the fund agreed to increase the funding program to $56.3 billion. But in 2021, the amount was reduced to 44 billion.

https://ria.ru/20230701/argentina-1881606944.html

GarryB, d_taddei2, kvs and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°288

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Beijing has responded to curbs imposed by the US and its allies by restricting exports of key rare metals.

China has pushed back against US-led efforts to block advances in its chipmaking industry, by slapping restrictions on exports of key raw materials that its Western rivals need for producing semiconductors.

The new export controls, announced on Monday by the Chinese Commerce Ministry, will take effect on August 1 and apply to gallium and germanium – rare metals used in making computer chips and a variety of other products, such as solar panels and advanced radar equipment. Exporters will need “special permission” to ship either of the two metals or their derivative compounds out of China, the ministry said, citing national security interests.

China is the world’s top producer of gallium and is a leading exporter of germanium. The European Union has included both metals on its list of critical raw materials, meaning they are considered “crucial to Europe’s economy.” The US hasn’t produced any gallium since 1987 and relied on China for 53% of its imports of the material between 2018 and 2021, according to the US Geological Survey.

Beijing’s announcement comes just three days after the Dutch government imposed new restrictions on exports of advanced semiconductor equipment, backing US efforts to block China from accessing technology deemed critical to development of artificial intelligence.

Amsterdam’s move drew an angry response from the Chinese government, which claimed that the US was coercing other countries to help maintain its “global hegemony” and implement “semiconductor suppression against China.” Beijing added that the Netherlands should “refrain from abusing export control measures” to help maintain stability of the semiconductor industry’s global supply chain.

The new restrictions on raw materials apparently deliver on China’s warning about the chipmaking supply chain. An editorial published on Monday in the state-owned China Daily newspaper suggested that Beijing’s move was made in retaliation for the curbs imposed by the US and its allies.

“Those doubting China’s decision could ask the US government why it holds the world’s largest germanium mines but seldom exploits them,” the editorial said. “Or they could ask the Netherlands why it included certain semiconductor-related products, such as lithographic machines, into its export control list. It is they that challenge the world supply chain, and the blames that belong to them should never be shifted to China, as it's defending its own legal national interests in this rather uncertain world.”

https://www.rt.com/news/579165-china-metals-semiconductor-restrictions/

GarryB, kvs and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°289

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Portal 'Euro Es Euro' points out that Beijing intends to absorb the loan, if Argentina can pay IMF with foreign exchange resources.

China's representative to the International Monetary Fund (IMF), Zhengxim Zhang, told the financial body that if a new agreement is not made with Argentina, Beijing may assume a debt contracted by Buenos Aires during the government of Mauricio Macri (2015-2019). The Euro es Euro portal reports.

The article interprets the Chinese official's statement as a" provocation", since it" removes the IMF from the role of creditor", allowing China to assume the debt with resources from foreign exchange exchanges made between the two countries.

Zhang "played hardball for Argentina" by sending an internal note to the IMF board announcing that if the Fund "continues to delay approval of the agreement, China will authorize Buenos Aires to use the second part of its foreign exchange exchange for debt repayment."

The representative makes reference to the agreement opened during the trip of an economic team of the Argentine government this Tuesday (11/07) to Washington, in the United States.

The South American delegation went in search of closing a negotiation with the IMF that contemplates Argentina's difficulties in meeting the deadlines stipulated by the organization.

According to the Russian newspaper RT en español, the government of President Alberto Fernández intends to reformulate the debt maturity schedule.

Foreign exchange between Argentina and China

According to the Euro Es Euro, Argentina and China have made "foreign exchange swap" procedures, that is, exchanges between currencies (Argentine pesos and yuan, respectively) so that the foreign exchange market does not present dysfunctional movements, such as the devaluation of some currency.

The latest exchange was renewed by Argentina's Economy Minister Sergio Massa and the country's Central Bank President Miguel Ángel Pesce on their last trip to Beijing in early June.

The two countries have a foreign exchange swap of 130 billion yuan, equivalent to US$ 19 billion, which represents 60% of the gross reserves of the Argentine central bank.

Among the financial possibilities that the Argentine government can realize with part of this reserve (about$ 5 billion) are the financing of imports from China and the payment of debt to the IMF.

In this way, Argentina cleared part of the account on June 30 with this reserve in yuan.

The portal also highlights that this amount can be renewed for another $ 5 billion, totaling $ 10 billion for imports or the IMF payment.

Thus, if the international lending body does not approve a new schedule for the payment of argentina's debt, China can authorize the use of the remaining$ 9 billion resulting from its exchanges for the solution of the collection.

Yandex Translate from Portuguese

https://www.brasil247.com/mundo/china-ameaca-fmi-de-assumir-divida-argentina-caso-novo-acordo-nao-seja-feito.

GarryB and d_taddei2 like this post

JohninMK- Posts : 15132

Points : 15273

Join date : 2015-06-16

Location : England

- Post n°290

Re: World Economic News and Discussion

Re: World Economic News and Discussion

@GeromanAT

·

10h

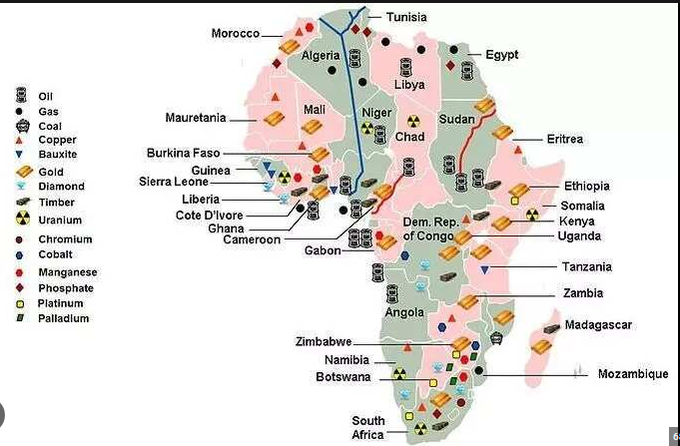

- The Battle for Africa -

It was never about spreading "democracy"

May the people win.

GarryB, kvs and zardof like this post

franco- Posts : 6796

Points : 6822

Join date : 2010-08-18

- Post n°291

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Russia added $600 billion of total wealth, the Swiss bank found in its annual Global Wealth Report, published Tuesday.

The number of Russian millionaires also rose by about 56,000 to 408,000 in 2022, while the number of ultra-high-net-worth individuals — people worth over $50 million — jumped by nearly 4,500.

But the US lost more wealth than any other country last year, shedding $5.9 trillion, while North America and Europe combined got $10.9 trillion poorer, UBS reported.

Zurich, 15 August 2023 – The fourteenth edition of the Global Wealth Report was launched today jointly by Credit Suisse and UBS. It shows that measured in current nominal USD, total net private wealth fell by USD 11.3 trillion (–2.4%) to USD 454.4 trillion at the end of 2022. Wealth per adult also declined by USD 3,198 (–3.6%) to reach USD 84,718 per adult. Much of this decline comes from the appreciation of the US dollar against many other currencies. Financial assets contributed most to wealth declines in 2022 while non-financial assets (mostly real estate) stayed resilient, despite rapidly rising interest rates.

Regional and demographic themes:

- Regionally, the report shows the loss of global wealth was heavily concentrated in wealthier regions such as North America and Europe, which together shed USD 10.9 trillion.

- Asia Pacific recorded losses of USD 2.1 trillion.

- Latin America is the outlier with a total wealth increase of USD 2.4 trillion, helped by an average 6% currency appreciation against the US dollar.

- Heading the list of losses in market terms in 2022 is the United States, followed by Japan, China, Canada and Australia.

- The largest wealth increases at the other end were recorded for Russia, Mexico, India and Brazil.

- In terms of wealth per adult, Switzerland continues to top the list followed by the USA, Hong Kong SAR, Australia and Denmark despite sizeable reductions in mean wealth versus 2021.

- Ranking markets by median wealth puts Belgium in the lead followed by Australia, Hong Kong SAR, New Zealand and Denmark.

When looked at in demographic terms, Generation X and Millennials continued to do relatively well in 2022 in the USA and Canada but were not immune to the overall wealth reduction. Broken down by race, non-Hispanic Caucasians in the USA saw their wealth decrease in 2022, while African-Americans were left almost unscathed by the downturn. In contrast, Hispanics achieved 9.5% growth in 2022, owing to their greater holdings of housing assets compared to financial assets.

Reduction in wealth inequalities

Along with the decline in aggregate wealth, overall wealth inequality also fell in 2022, with the wealth share of the global top 1% falling to 44.5%. The number of USD millionaires worldwide fell by 3.5 million during 2022 to 59.4 million. This figure does not, however, take into account 4.4 million “inflation millionaires” who would no longer qualify if the millionaire threshold were adjusted for inflation in 2022.

Global median wealth, arguably a more meaningful indicator of how the typical person is faring, did in fact increase by 3% in 2022 in contrast to the 3.6% fall in wealth per adult. For the world as a whole, median wealth has increased five-fold this century at roughly double the pace of wealth per adult, largely due to the rapid wealth growth in China.

A brighter outlook

According to the report’s projections, global wealth will rise by 38% over the next five years, reaching USD 629 trillion by 2027. Growth by middle-income markets will be the primary driver of global trends. The report estimates wealth per adult to reach USD 110,270 in 2027 and the number of millionaires to reach 86 million while the number of ultra-high-net-worth individuals (UHNWIs) is likely to rise to 372,000 individuals.

https://www.ubs.com/global/en/media/display-page-ndp/en-20230815-global-wealth-report-2023.html

GarryB, flamming_python, d_taddei2, kvs and Sprut-B like this post

kvs- Posts : 15480

Points : 15617

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°292

Re: World Economic News and Discussion

Re: World Economic News and Discussion

lancelot wrote:This has been discussed for decades. I hope so, but remains to be seen if it will happen.

The US engineered regime change in Thailand in the last few weeks so Thailand is not a good host for a canal that would be secure for

China. China needs a good navy to put the self-anointed masters of the universe in their place.

US attempts to terrorize states with control over shipping bottlenecks only works if it is not risking all of its precious ships being sent to

the sea floor. If it wants to escalate to nuclear war, China can send enough ICBMs to reduce the exceptional Yankee toilet to the

stone age.

higurashihougi- Posts : 3176

Points : 3263

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°293

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Ukraine not invited to G20 – India

An invitation for the group’s summit in New Delhi has not been extended to Kiev, the Indian foreign minister has said

Indian Foreign Minister Subrahmanyam Jaishankar has reiterated New Delhi’s position on Ukraine’s potential participation at the G20 summit in September.

Speaking to the media on Wednesday, Jaishankar stated that Ukraine had not been extended an invitation to the high-profile gathering of leaders of the world’s major economies, which includes Russia, a permanent member of the G20.

The foreign minister said that in addition to G20 member states, India had sent invitations to Spain, Bangladesh, Nigeria, Mauritius, Egypt, the Netherlands, Oman, Singapore, and the United Arab Emirates, EFE news agency reported.

Jaishankar explained that India’s position on Ukraine’s participation is due to the fact that the G20 is primarily focused on fostering growth and development, leaving matters of conflict resolution to be addressed at the UN Security Council.

He also noted that Indian Prime Minister Narendra Modi had previously engaged with his Ukrainian counterpart on numerous occasions, underlining the “robust” relations between the two nations across various domains.

GarryB, d_taddei2, zardof, Sprut-B and Broski like this post

GarryB- Posts : 39672

Points : 40168

Join date : 2010-03-30

Location : New Zealand

- Post n°294

Re: World Economic News and Discussion

Re: World Economic News and Discussion

flamming_python and zardof like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°295

Re: World Economic News and Discussion

Re: World Economic News and Discussion

The new era opened with the strategic tour de force inbuilt in the creation of BRICS 11 involves the make-or-break issue of setting up a new international economic/financial strategy.

Right at the heart of fervent discussions are the merits of designing a new BRICS currency.

Brazilian economist Paulo Nogueira Batista Jr., a former IMF director who was deeply involved with BRICS from 2007 to 2015, has noted how a reserve currency discussion among the original five members was already too difficult. With 11, even more so.

A currency has to be issued by a sovereign government. The indispensable Michael Hudson has cut to the chase to focus on what President Putin stressed in the summit in Johannesburg: what is needed is a means of settlement among Central Banks to keep in check the imbalances of trade and investment in their balance of payments.

That implies no BRICS supra-national gold backed currency.

Prof. Hudson has observed that, “nobody uses gold as a currency. You don’t go to the grocery store or you don’t buy stocks and bonds or even houses with gold. You’re not going to be able to do it with anything like a BRICS currency within the future.”

So the possible “BRICS currency” on a - distant? – future will be “only a narrow currency that only governments can spend for each other, and it’s created on a computer. It’s not anything that you can hold in your pocket to spend.”

You Can’t Pay for Your Coffee with This

Michael Kumhof, a senior advisor for the Bank of England, adds a few more elements: “A currency does not need to be issued by a single state, instead its issuance can be delegated by a group of states to a common institution, see the ECB [European Central Bank]. And while that currency would be unlikely to be used by people to buy a coffee (although who knows, given enough time), it could be used by corporations for invoicing in cross-border trade.”

Kumhof projects a different future: “Imagine if 50-100 countries joined BRICS, some of them with pretty small, marginal currencies. They might appreciate being able to invoice and settle in a strong common currency rather than only having a choice between USD and, say, RMB. Not to mention the fact that if the Chinese want to keep some of their capital controls (good idea for now, I think), the RMB could not really fully replace the USD in such transactions. A BRICS currency would not be subject to such restrictions. This BRICS bank would buy up bonds of member countries according to some quota, and then issue a common currency against it, with all its gains and losses shared by member governments. That could create an arbitrarily large amount of liquidity (and firepower for BRICS) without requiring any debt to do so, in fact massively reducing debt while doing so. And of course I agree that this would need to be supplemented by a bancor-type arrangement to clear cross-country imbalances.”

What’s certain for now is that at the heart of what’s coming next will be an enhanced role for the New Development Bank (NDB), the BRICS bank, headquartered in Shanghai and now presided by former Brazilian President Dilma Rousseff.

Sergey Glazyev, the Minister of Macroeconomics at the Eurasia Economic Commission, an arm of the EAEU, has been very critical of the NDB, explaining how the bank statutes are linked to the US dollar; and that’s the reason why the bank is now semi-paralyzed, afraid of secondary US sanctions.

That brings to the fore another issue stressed by Kumhof: the BRICS-IMF connection. Kumhof observes, “it seems to me that the NDB is basically a World Bank, while I have heard very little about the Contingent Reserve Arrangement, which at one point was mentioned as a sort of embryonic BRICS-IMF."

What China Really Wants

This analysis , which caught Glazyev’s attention, delves on why the BRICS will not be able to become a competitor to reserve currencies – especially the US dollar and the euro - and launch full-fledged dedollarization right away.

The gist of the argument is that only China “can claim to create a reserve currency”, as “the scale, depth of diversification and level of development of the Chinese economy are sufficient to compete with the US and the Eurozone.”

The problem, according to the analysis, is that “reserve status cannot arise under conditions of restrictions on capital flows.”

That brings us to the restricted convertible yuan, as there are “limits for foreign exchange that vary by region and investment destinations”; limits on “repatriation of capital through dividends and interest”; “industry capital withdrawal quotas for sensitive industries”; and “strict requirements for registration of foreign companies”, among other issues.

So the analysis in fact boils down to raw capitalism:

"There are no competitors to the dollar and euro in the international capital market and none are expected in the near future, because in order for the yuan to come out of the shadows China must liberalize financial policy and remove restrictions on capital control.”

So “any breakdown of the existing world order in the currency market should be viewed exclusively through the focus of China.”

But the thing is Beijing is not interested in having the yuan assuming the role of a world reserve currency. And neither were the BRICS, even before BRICS 11.

The Chinese focus is increasing yuan trading and cash and settlement operations (roughly 4.5-5% of global turnover as of this month).

In the next stage there will be more cross-border funding (as in yuan loans) and more attraction of international capital in yuan-denominated financial instruments. We’re not there yet.

The analysis is correct to identify China’s priorities as “expanding the yuan's presence in the external market and resetting internal entropy through decentralization and international spread of the yuan money supply.”

The analysis is also not off the mark when it concludes that the yuan is not a competitor to the US dollar or the euro: “They are in different dimensions, at different stages of development and with a different development trajectory.”

So what’s bound to happen next is “more pronounced yuanization among neutral countries, where China will take subordinate and dependent countries into its orbit, expanding its influence.”

We’re not Gonna Take it Anymore

Michael Hudson’s vision is way more sophisticated, and goes way beyond the internationalization of the yuan or the need for a BRICS currency. He touches the heart of the problem for the Global South/Global Majority/Global Globe:

“The Global South countries have an economic catheter into their monetary bloodstream, draining their balance-of-payments surpluses to pay the post-colonial (or perhaps we should say neo-colonial) burden of dollarized ‘dependency arrears’ from being blocked from balancing their foreign trade and investment.”

He adds, “if countries have to keep paying their export earnings and new borrowing (such as Argentina’s borrowing of yuan from China) to pay the IMF and other dollar holders (often their own domestic kleptocratic elite), then how can they accumulate yuan, rubles, rupees, rials and other Global South currencies? For this to occur they have to say, ‘Now that we have kicked out the French colonialists and U.S. NGOs, we have to annul the bills they are holding for making us pay for the warped investment and trade patterns that have been forced upon us since World War II.”

It goes without saying imperial forces, even in their current disarray, will accept that over their dead bodies. Still, Prof. Hudson is relentless when denouncing how the IMF and the World Bank “pushed resource allocation away from domestic food production to export-crop production, and away from import substitution to import dependency – all capped by privatization sell-offs of basic infrastructure to foreigners to impose monopoly pricing and capital flight instead of providing basic services at subsidized prices to make their economies more competitive, as the U.S. and Europe were doing with their own economies.”

That, as Prof. Hudson stresses, is where the political discussion should focus on. Call it a direct message to the BRICS 11. And that is way more relevant than speculating about a far and away BRICS currency.

https://sputnikglobe.com/20230831/pepe-escobar-does-brics-need-its-own-currency-1113013286.html

GarryB likes this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°296

Re: World Economic News and Discussion

Re: World Economic News and Discussion

After losing the lead in exports of soybeans and wheat, the United States undergoes another bitter defeat to be overtaken by Brazil in the world corn market. Learn why Sergio Mendes, director general of Brazil's National Association of cereal exporters, believes Brazil will not be unseated from this leadership anytime soon.

Brazil overtook the United States to become the world's largest corn exporter in the 2023 agricultural year, which ended in August. The finding is from the US Department of Agriculture (USDA) itself.

The loss of US leadership in the corn market is another defeat for US agriculture, which in recent decades has already ceded first place in soy and wheat exports to Brazil and Russia, respectively.

Recent data indicate that the U.S. accounts for only one-third of the world's soybean exports, well below Brazil's level. In the wheat market, the former Export leaders, USA, now embitter the fifth place in the global ranking, as Bloomberg reported.

All indications are that the loss of U.S. leadership in corn exports will not be reversed either. In the last year, Brazil accounted for 32% of world grain exports, while the United States, which traditionally occupies the world leadership in the segment, occupied only 23% of the market.

The US data also indicate that Brazil exported 56 million tons of corn, while the US sold only 41.277 million.

According to the Director General of the National Association of cereal exporters of Brazil (ANEC), Sergio Mendes, Brazil has the potential to remain in the lead in the coming years.

"I see no obstacles for us to continue in the lead, unless there is some unexpected climate event," Mendes told Sputnik Brasil. "The future trend for the Brazilian corn crop is one of growth."

According to him, corn was incorporated by soybean producers as an intermediate crop for soybeans, grown in the off-season.

"The producers sought the ideal crop to be planted in the soybean off-season, using the same soil. And corn has proven to be the ideal partner," Mendes explained. "This is perhaps the main reason that has led corn to reach the position in which it is today."

The Managing Partner of the consultancy Markestrat, specialized in agribusiness strategy, José Carlos De Lima Júnior, also points to the increase in the use of technology in the Brazilian corn crop.

"Before we didn't have the level of application of Technology per hectare in corn," Lima Junior told Sputnik Brasil. "Currently, the producer has realized that corn can be much more than a soil recomposition crop and, in fact, bring effective income. That is why it began to invest in technology, especially in the term of seeds."

Competition with the USA

The U.S. has held the lead in World corn exports for decades. Historically, Brazil had only surpassed the US in this culture once, in 2013. One of the obstacles to US exports is that Washington needs, first of all, to ensure the supply of its domestic market.

"The Brazilian domestic market is not as relevant as the US, so our production can be largely reverted to export," said ANEC director Sergio Mendes. "This gives security to the importer that the supply of Brazilian corn is guaranteed."

In addition, the US faced difficulties due to the instability of prices for nitrogen fertilizers, which Washington imported mainly from Canada, necessary for growing corn.

"The North American producer had to make a crop decision at the same time of rising nitrogen production and price instability, which led him to reduce the area planted with corn and increase the area of soybeans," explained consultant Lima Júnior.

China Factor

The trade war initiated by President Donald Trump against China may also have negatively reflected on US corn exports.

"The trade clash between the US and China persists to the present day, since even with Biden's entry, protectionist guidelines were maintained," Lima Júnior said. "The consequence was that the US ended up exporting less and Brazil captured a part of the market that was previously owned by the Americans."

Despite the stumbles in U.S. domestic management, Chinese grain demand is sure to be a determining factor in determining who will be the world's top corn exporter. China has actively bet on Brazil as an alternative corn supplier to the US by sealing a bilateral agreement in 2022 to ensure increased bilateral grain trade.

The result was a significant increase in Brazilian corn exports to China. If, in July 2022, China had not imported any tons of Brazilian corn, in the same month of 2023 Beijing was the main buyer, importing 902,000 tons.

China consolidates its position as the main buyer of Brazilian agribusiness, which does not bring losses to the producer, believes consultant Lima Júnior.

"I see no problem with Brazil having a major trading partner. The problem is to stop opening other business fronts, with other countries, just because we have a key partner in hand", considered Lima Júnior. "China knows what it wants from Brazil, but Brazil doesn't know what it wants from China."

In the short and medium term, however, China's role will remain fundamental for the corn produced in Brazil. If previously, Chinese demand for corn was mainly supplied by Washington, Brasilia and Buenos Aires, with the Argentine crop failure, exports to China between 2022 and 2023 ended up being practically dominated by Brazilian agribusiness.

ANEC's Director General, Sergio Mendes, acknowledges that Brazil's success may have hurt the country's main competitors, but credits the corn's good performance to the planning carried out nationally.

"Our corn crop was very good. This growth has been a well-sustained and planned project over the years. We do not need the unhappiness of others to grow, let this be very clear", concluded the director general of ANEC.

Yandex Translate from Portuguese

https://sputniknewsbr.com.br/20230906/tiro-da-guerra-comercial-sai-pela-culatra-e-brasil-captura-mercado-dos-eua-na-china-diz-analista--30192683.html

GarryB, flamming_python, kvs and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°297

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Both countries are the world's largest exporters of the product.

Brazil is close to overtaking the United States and becoming the world's largest cotton exporter, since Texas. The two countries are the world's largest cotton exporters, together accounting for more than half of global supply. The U.S. is expected to export 12.5 million bales in the 2023-24 season, but that estimate is likely to be lowered when the U.S.

Department of Agriculture updates its projections on Tuesday. Brazil is expected to ship 11.25 million bales. A bale of cotton fiber ranges from 200 kilograms to 225 kilograms.

According to information published on Monday (11) by Brazilian newspaper Folha de Sao Paulo, the director of risk management at Plexus Cotton, Peter Egli, "if the United States crop continues to deteriorate, Brazil could easily overtake them". "The two countries are already equal in basic statistics. It is conceivable that Brazil will become the world's largest exporter this season," he said.

Brazil overtook the U.S. in the agricultural year ended Aug.31. Several factors have contributed to a change in the global agricultural landscape. Among them are the increase in production costs in the United States. The dollar also affected the competitiveness of agricultural products in the US, which is the largest global economy.

Yandex Translate from Portuguese

https://www.brasil247.com/economia/brasil-se-aproxima-dos-eua-e-pode-virar-maior-exportador-de-algodao-do-mundo

GarryB, kvs and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°298

Re: World Economic News and Discussion

Re: World Economic News and Discussion

The European Commission will now have up to 13 months to assess whether to impose higher tariffs on Chinese electric vehicles.

The president of the European Commission, Ursula von der Leyen, announced on Wednesday that the European Union has decided to launch an investigation into Chinese subsidies for electric vehicles to prevent an avalanche of cheap imports.

"World markets are now flooded with cheaper electric cars. And its price is kept artificially low thanks to huge state subsidies," Von der Leyen was quoted as saying by Reuters. The Commission will now have up to 13 months to assess whether to impose tariffs higher than the EU's standard 10% rate on cars.

The investigation is "part of a broader rethink by the governments of developed economies to bring production closer to home, especially for key sectors such as semiconductors, pharmaceuticals and heavy industries, which were disrupted during the covid-19 pandemic," Bloomberg writes.

Possible consequences

A person familiar with the matter told Bloomberg that the measure may lead to tariffs close to the 27.5% already imposed by the US on Chinese electric vehicles. He also added that EU tariffs could vary depending on the producer.

In addition, if the bloc imposes additional tariffs, one of the important markets for Chinese electric vehicle exports will be reduced, raising the prospect of a cascade of defensive measures in places like the United Kingdom to protect their markets from the flood of vehicles coming from the EU, the agency notes.

Meanwhile, a source familiar with the situation indicated that EU officials have also been studying other Chinese sectors, but do not have any ongoing investigation.

However, according to Bloomberg, "addressing Chinese subsidies - even if confirmed - will also not change the view that Chinese vehicles are technologically advanced and European carmakers have been slow to adapt and innovate."

"A poison for the European economy"

After the news broke, the shares of Chinese electric vehicle manufacturers had a mixed behavior. Meanwhile, BYD Co Ltd. and SAIC Motor Corp Ltd. they fell more than 3% in mainland China, Li Auto Inc. and XPeng Inc. they opened lower in Hong Kong, but quickly recovered and gained more than 1%.

For its part, the Chinese Ministry of Commerce said that the investigation is "blatant protectionism that will seriously disrupt and distort the supply chain of the global automotive industry, including the EU, and will have a negative impact on China-EU economic and trade relations."

In this context, Beijing urged the EU to "engage in dialogue and consultations with the Chinese side to create fair, non-discriminatory and predictable market conditions for the joint development of the China-EU electric vehicle industry."

Meanwhile, Global Times wrote in an article that "trade protectionism will become a poison for the European economy" and will not "boost the European car industry", but "will only pass the costs on to European consumers and hinder the achievement of Europe's climate goals".

"The European car industry cannot afford a 'trade war' with China," the newspaper notes, adding that any dispute between the two sides will only make American carmakers the biggest winners.

Yandex Translate from Spanish

https://actualidad.rt.com/actualidad/479868-europa-iniciar-guerra-comercial-china

GarryB, xeno, kvs and Broski like this post

lancelot- Posts : 2872

Points : 2870

Join date : 2020-10-18

- Post n°299

Re: World Economic News and Discussion

Re: World Economic News and Discussion

GarryB, kvs and Broski like this post

Kiko- Posts : 3203

Points : 3261

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°300

Re: World Economic News and Discussion

Re: World Economic News and Discussion

Brussels has embarked on one of the most serious confrontations with Beijing. It begins an investigation into electric vehicles from China in order to obtain formal grounds for removing the “Chinese” from the market. However, the EU should think carefully: Beijing has the coveted batteries, without which European car factories simply will not cope with their “green” transition.

Europe is escalating trade relations with China. The EC has announced an investigation into China, which is accused of flooding the European market with electric cars. Brussels believes prices for Chinese-made electric cars have been artificially low due to huge government subsidies.

China's share of electric vehicle sales in Europe has risen to 8% and could reach 15% in 2025, according to the EC. Last year, 35% of all electric vehicles exported in the world were produced in China, which is 10% more than the previous year (data from the American CSIS center).

This year, for example, Chinese brand BYD has made a big splash, dethroning Volkswagen as the top-selling car brand in China by expanding sales to about 15 European countries. The Atto 3 crossover became the best-selling electric car in Sweden in July. At the same time, BYD intends to offer new models. At the end of the year, the Seal sedan will go on sale, the cost of which in Germany will be about 45,000 euros. This puts it in direct competition with the Tesla Model 3 and some Volkswagen vehicles.

Shares of Chinese electric vehicle makers fell immediately after the news from Brussels. Beijing called the EC investigation protectionist and warned it would damage economic and trade relations between the two countries. According to China, the competitive advantage of Chinese electric vehicles was not due to subsidies.

The China Passenger Car Association notes that Chinese-made cars exported to Europe typically cost almost twice as much as they sell in China.

At the same time, when they talk about Chinese electric cars, we are also talking about Western brands that assemble cars in China.

Beijing notes that the single largest exporter of electric vehicles from China to the EU is actually the American giant Tesla. It accounted for 40.25% of China's electric vehicle exports between January and April 2023.

The purpose of the EC's investigation is to obtain justification for introducing punitive duties on electric vehicles produced in China.

The irony is that the EU intends to ban the purchase of new combustion engine cars in 2035 as part of its ambitious Green Deal plan to cut elections. They should be replaced by electric cars, and this market should be supported in every possible way, but Brussels is trying to remove the “Chinese” from its market. The European Union fears that the growing popularity of cheaper Chinese electric vehicles could undermine the “green” transition of its own European automakers, says Anna Buylakova, an analyst at Finam Financial Group.

“The European Union may have entered one of the most difficult confrontations in recent times. The EC's investigation could lead to new EU tariffs on imports of Chinese electric vehicles and devastate major non-European automakers such as Tesla, which make cars in China for export to the EU.

On the one hand, by tightening duties, the EU will stimulate European manufacturers of electric vehicles, but on the other hand, China is a major supplier of raw materials and components for European industry. In addition, China is the most important market for German cars. China may respond by limiting their access to its market,” says Sergei Ramaninov, an analyst at the Markets Money Power channel.

Experts have not yet discussed whether the EC’s accusations are justified. However, Ramaninov believes that the likelihood of introducing duties based on the results of the investigation is not as high as it may initially show. At least according to the statement of the German Minister of Economy, who stated that “this is not about keeping high-performance, low-cost cars out of the European market; it’s about looking at whether there are hidden, direct or indirect subsidies that create an unfair competitive advantage.”

However, such investigations often lead to the imposition of tariffs on foreign products. Similar accusations, for example, were repeatedly heard by producers of Russian fertilizers (long before February 2022), which, according to European officials, were hiddenly subsidized due to cheap gas prices. For example, the EU conducted an anti-dumping investigation and introduced duties on Russian fertilizers (Eurochem, Acron) back in 2019. Even Ukrainian grain was recently banned from being exported to the EU for much the same reason - because it is cheap and ruins European farmers. And it is cheap, of course, because of hidden subsidies - due to cheap labor, etc.

An alternative scenario for the investigation could be a global one, in which Beijing agrees with the accusations, raises prices on par with German VW, and makes certain trade concessions. For example, it will reduce prices for European factories for its batteries and open its market wider to European goods.

European officials surprise with their ambivalent position. On the one hand, with their own hands they are killing part of their own energy-intensive industry (chemistry, metallurgy), abandoning Russian energy resources, primarily gas. On the other hand, there is so much commotion around our own production of electric vehicles.

If the EU nevertheless increases duties on electric cars from China, the West’s trade war with China will seriously escalate. Beijing will not silently watch this and will take retaliatory steps.

And China has something to harm Europeans with. For example, 16% of batteries and electric vehicles sold in the EU last year were produced in China. How will European automakers produce their own electric cars without Chinese batteries?

“Any retaliatory measures from Beijing could hit the Europeans. China already controls 60% of global battery production. Where will European companies source batteries for their eco-friendly cars? German automakers, which have huge production capacities in China, will suffer the most. Until recently, Volkswagen was the largest seller in China, while BMW and Mercedes dominated the premium market,” notes Sergei Ramaninov.

It is no coincidence that the news about the investigation caused the shares of not only Chinese automakers to fall, but also European automakers too.

https://vz.ru/economy/2023/9/15/1230479.html

GarryB, kvs and Broski like this post

|

|

|