+32

Arkanghelsk

JohninMK

Broski

higurashihougi

AlfaT8

TMA1

marcellogo

Scorpius

lyle6

Isos

lancelot

sepheronx

Podlodka77

Big_Gazza

SaneBomber

Aristide

kvs

Tsavo Lion

OminousSpudd

GarryB

magnumcromagnon

Werewolf

franco

flamming_python

PapaDragon

par far

type055

George1

Battalion0415

Hannibal Barca

macedonian

nemrod

36 posters

China's development as a superpower

JohninMK- Posts : 14692

Points : 14827

Join date : 2015-06-16

Location : England

- Post n°101

Re: China's development as a superpower

Re: China's development as a superpower

Wonder if "Unknown" is the sanctions friendly descriptor for Russia?

Walther von Oldenburg likes this post

andalusia- Posts : 728

Points : 790

Join date : 2013-10-01

- Post n°102

Re: China's development as a superpower

Re: China's development as a superpower

US politicians are afraid of competition from China of EV vehicles being imported into America from Mexico. https://fortune-com.cdn.ampproject.org/v/s/fortune.com/2023/12/30/chinese-electric-vehicles-makers-mexico-plans-spark-fears-in-us/amp/?amp_gsa=1&_js_v=a9&usqp=mq331AQGsAEggAID#amp_tf=From%20%251%24s&aoh=17039920226582&csi=0&referrer=https%3A%2F%2Fwww.google.com&share=https%3A%2F%2Ffortune.com%2F2023%2F12%2F30%2Fchinese-electric-vehicles-makers-mexico-plans-spark-fears-in-us%2F

GarryB and kvs like this post

kvs- Posts : 15131

Points : 15268

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°103

Re: China's development as a superpower

Re: China's development as a superpower

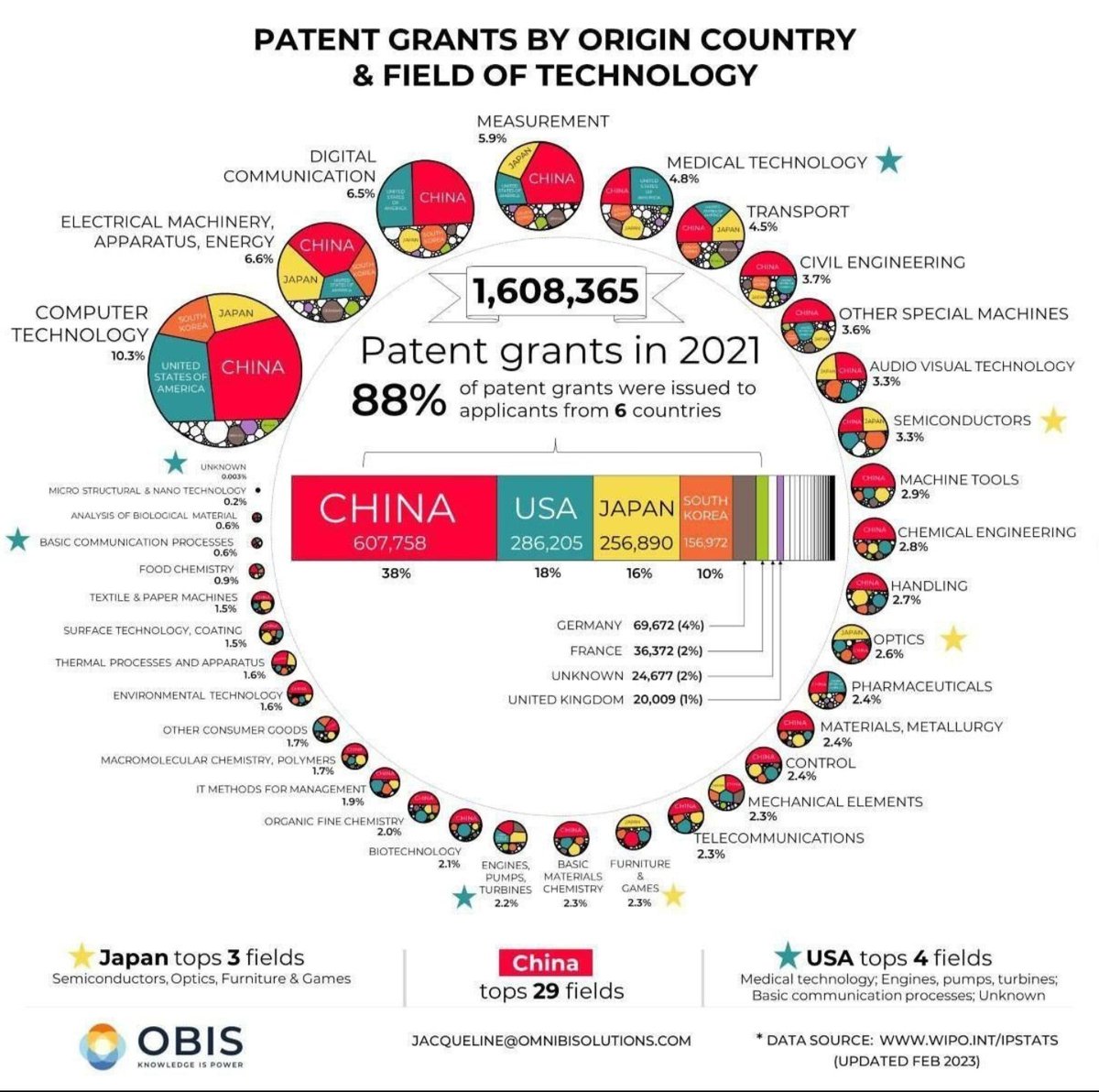

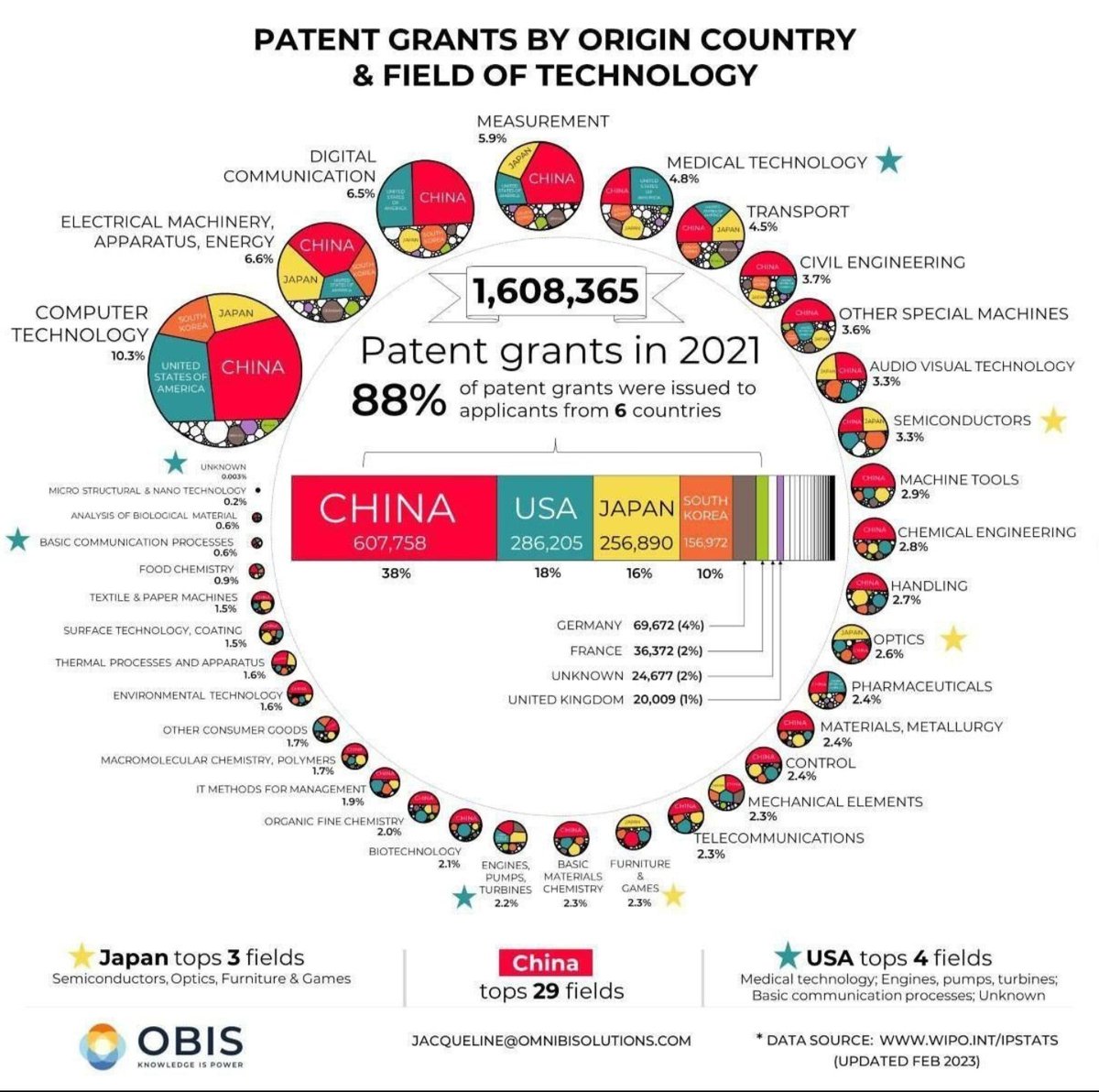

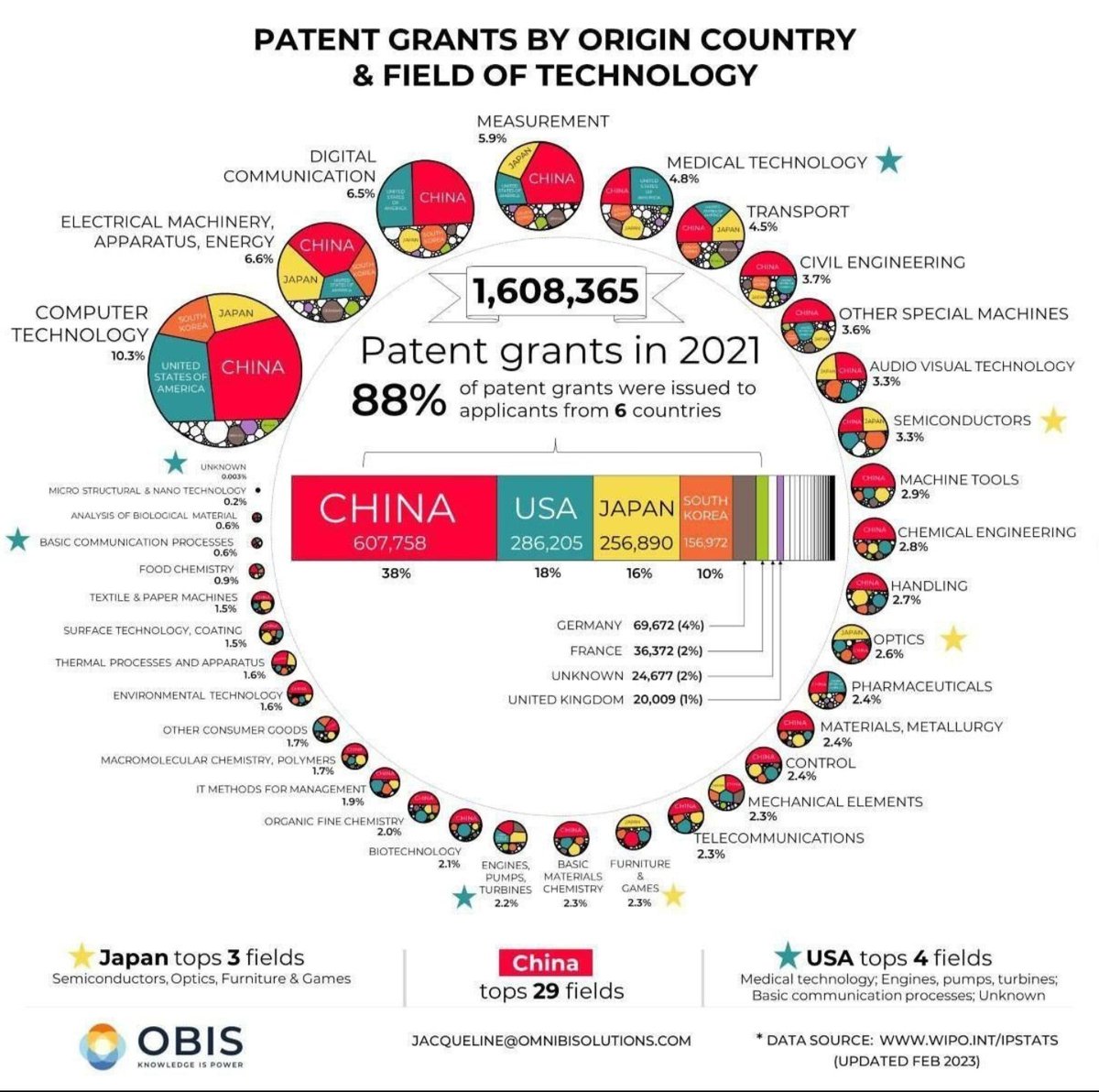

Number of patents is a weak metric of technological level. Most patents are fluff and essentially troll efforts. It is common in the corporate realm

to use patents to attack competitors so there is a "patent arms race" where companies file all sorts of BS patents to then use as weapons. This sort

of absurdity is enabled by patent offices. The US patent office is notorious for allowing filing of blank patents which can be filled within a 3 year window.

We had the case of patent trolls Rambus using JDEC open session meetings on SDRAM to fill in their "patent" which they then used to sue every

RAM maker. This is a well known case because it was reported on, there must be hundreds of similar cases that are not reported on. It is a massive

make-work project for lawyers and and example of how the legislative and legal systems have been corrupted.

In the case of China there must be less of this American style BS, but quantity does not equal quality in any case.

BTW, Taiwan does not even register on the computer technology bubble even though TSMC engineers have advanced the field of chip manufacturing.

This is real world impact and not pieces of virtual paper filed in some patent office.

to use patents to attack competitors so there is a "patent arms race" where companies file all sorts of BS patents to then use as weapons. This sort

of absurdity is enabled by patent offices. The US patent office is notorious for allowing filing of blank patents which can be filled within a 3 year window.

We had the case of patent trolls Rambus using JDEC open session meetings on SDRAM to fill in their "patent" which they then used to sue every

RAM maker. This is a well known case because it was reported on, there must be hundreds of similar cases that are not reported on. It is a massive

make-work project for lawyers and and example of how the legislative and legal systems have been corrupted.

In the case of China there must be less of this American style BS, but quantity does not equal quality in any case.

BTW, Taiwan does not even register on the computer technology bubble even though TSMC engineers have advanced the field of chip manufacturing.

This is real world impact and not pieces of virtual paper filed in some patent office.

sepheronx and GarryB like this post

GarryB- Posts : 38999

Points : 39495

Join date : 2010-03-30

Location : New Zealand

- Post n°104

Re: China's development as a superpower

Re: China's development as a superpower

It is very funny though that if someone suggests basic universal healthcare for all Americans that is communism, but suggesting universal protection for US companies to protect them from better products being made cheaper and sold cheaper in the US market is being patriotic.

I would say they have those two things arse about.

I would say they have those two things arse about.

kvs likes this post

higurashihougi- Posts : 3104

Points : 3191

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°105

Re: China's development as a superpower

Re: China's development as a superpower

https://www.nytimes.com/2024/03/07/business/china-solar-energy-exports.html

How China Came to Dominate the World in Solar Energy

How China Came to Dominate the World in Solar Energy

China’s solar exports have already drawn urgent responses. In the United States, the Biden administration has introduced subsidies that cover much of the cost of making solar panels and part of the much higher cost of installing them.

The alarm in Europe is particularly great. Officials are bitter that a dozen years ago, China subsidized its factories to make solar panels while European governments offered subsidies to buy panels made anywhere. That led to an explosion of consumer purchases from China that hurt Europe’s solar industry.

A wave of bankruptcies swept the European industry, leaving the continent largely dependent on Chinese products.

The remnants of Europe’s solar industry are now fading away. Norwegian Crystals, an important European producer of raw materials for solar panels, filed for bankruptcy last summer. Meyer Burger, a Swiss company, announced on Feb. 23 that it would halt production in the first half of March at its factory in Freiberg, Germany, and would try to raise money to complete factories in Colorado and Arizona.

GarryB and lancelot like this post

ALAMO- Posts : 6708

Points : 6798

Join date : 2014-11-25

- Post n°106

Re: China's development as a superpower

Re: China's development as a superpower

There is a quite similar effect in LED lighting technology.

When I started to get familiar with it, a Chinese LED bulb glowed 2W in dead bluish cold light.

European LED were ten times more expensive, but offered slightly better light waves, nominal power and light emission.

But that was 15 years ago

Chinese products were getting better and better and better, keeping the price at the same 1/10th of the Euro production.

It took them about half a decade to match the competition.

And they didn't stop there.

When I was purchasing lighting for my new home a few years ago - the Chinese-supplied offer was unmatched.

Not only by keeping the prices at a much lower level, but because of the technology.

7-8 years ago, a ceiling lamp from China offered remote control, dimming and light brightness/colour adjustments in a range up to 200W which is just fine for a 45m2, for $150.

No lamp of European origin offered the same, and the "ceiling lamps" were effective enough for a roughly 15 m2 space. At around 4x the price, but there is nothing close to compare.

The Chinese have been unmatched in LED technology for about a decade.

When I started to get familiar with it, a Chinese LED bulb glowed 2W in dead bluish cold light.

European LED were ten times more expensive, but offered slightly better light waves, nominal power and light emission.

But that was 15 years ago

Chinese products were getting better and better and better, keeping the price at the same 1/10th of the Euro production.

It took them about half a decade to match the competition.

And they didn't stop there.

When I was purchasing lighting for my new home a few years ago - the Chinese-supplied offer was unmatched.

Not only by keeping the prices at a much lower level, but because of the technology.

7-8 years ago, a ceiling lamp from China offered remote control, dimming and light brightness/colour adjustments in a range up to 200W which is just fine for a 45m2, for $150.

No lamp of European origin offered the same, and the "ceiling lamps" were effective enough for a roughly 15 m2 space. At around 4x the price, but there is nothing close to compare.

The Chinese have been unmatched in LED technology for about a decade.

GarryB, kvs and lancelot like this post

GarryB- Posts : 38999

Points : 39495

Join date : 2010-03-30

Location : New Zealand

- Post n°107

Re: China's development as a superpower

Re: China's development as a superpower

And their solar panels are better than western ones as well, plus they are cheap enough to use in large numbers.

Just small solar panels to put on a boat tied at a pier to keep the batteries topped up.

If you get a small leak then the bilge pump will stop the boat from sinking right away but it uses battery power so having the battery topped up all the time with a solar panel and backup panels so a sunny day they can run the bilge pumps and take a lot of water out of your boat is a real life saver if you don't visit it every week.

It also means you can wire in an alarm to keep kids off the boat.

These day the trend is for people to put LED lights in their gardens with solar panels keeping the batteries charged, but of course during winter you need as many solar panels as you can fit. Solar charge controllers will stop over charging.

Just small solar panels to put on a boat tied at a pier to keep the batteries topped up.

If you get a small leak then the bilge pump will stop the boat from sinking right away but it uses battery power so having the battery topped up all the time with a solar panel and backup panels so a sunny day they can run the bilge pumps and take a lot of water out of your boat is a real life saver if you don't visit it every week.

It also means you can wire in an alarm to keep kids off the boat.

These day the trend is for people to put LED lights in their gardens with solar panels keeping the batteries charged, but of course during winter you need as many solar panels as you can fit. Solar charge controllers will stop over charging.

kvs and ALAMO like this post

AlfaT8- Posts : 2467

Points : 2458

Join date : 2013-02-02

- Post n°108

Re: China's development as a superpower

Re: China's development as a superpower

Not sure if this should be placed in the propaganda thread.

So i'll post it here too.

So i'll post it here too.

GarryB- Posts : 38999

Points : 39495

Join date : 2010-03-30

Location : New Zealand

- Post n°109

Re: China's development as a superpower

Re: China's development as a superpower

Video is unavailable.

Video is private.

Video is private.

AlfaT8- Posts : 2467

Points : 2458

Join date : 2013-02-02

- Post n°110

Re: China's development as a superpower

Re: China's development as a superpower

GarryB wrote:Video is unavailable.

Video is private.

I am not encountering that issue.

Might need to use a VPN, because this guy has not updated any of his alt-tech platform accounts.

GarryB- Posts : 38999

Points : 39495

Join date : 2010-03-30

Location : New Zealand

- Post n°111

Re: China's development as a superpower

Re: China's development as a superpower

Now it works and hahahahaha.... the first two minutes is listing problems America has created for itself and blaming China for them.

Classy.

But the US is a super power, surely cutting some strings would not be that hard...

Classy.

But the US is a super power, surely cutting some strings would not be that hard...

higurashihougi- Posts : 3104

Points : 3191

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°112

Re: China's development as a superpower

Re: China's development as a superpower

https://www.engadget.com/china-bans-intel-and-amd-processors-in-government-computers-065859238.html

China bans Intel and AMD processors in government computers

It's also blocking Microsoft Windows and database products from foreign companies.

China has introduced guidelines that bar the the use of US processors from AMD and Intel in government computers and servers, The Financial Times has reported. The new rules also block Microsoft Windows and foreign database products in favor of domestic solutions, marking the latest move in a long-running tech trade war between the two countries.

Government agencies must now use "safe and reliable" domestic replacements for AMD and Intel chips. The list includes 18 approved processors, including chips from Huawei and the state-backed company Phytium — both of which are banned in the US.

The new rules — introduced in December and quietly implemented recently — could have a significant impact on Intel and AMD. China accounted for 27 percent of Intel's $54 billion in sales last year and 15 percent of AMD's revenue of $23 billion, according to the FT. It's not clear how many chips are used in government versus the private sector, however.

The moves are China's most aggressive yet to restrict the use of US-built technology. Last year, Beijing prohibited domestic firms from using Micron chips in critical infrastructure. Meanwhile, the US has banned a wide range of Chinese companies ranging from chip manufacturers to aerospace firms. The Biden administration has also blocked US companies like NVIDIA from selling AI and other chips to China.

The US, Japan and the Netherlands have dominated the manufacturing of cutting-edge processors, and those nations recently agreed to tighten export controls on lithography machines from ASL, Nikon and Tokyo Electron. However, Chinese companies, including Baidu, Huawei, Xiaomi and Oppo have already started designing their own semiconductors to prepare for a future wherein they could longer import chips from the US and other countries.

China bans Intel and AMD processors in government computers

It's also blocking Microsoft Windows and database products from foreign companies.

China has introduced guidelines that bar the the use of US processors from AMD and Intel in government computers and servers, The Financial Times has reported. The new rules also block Microsoft Windows and foreign database products in favor of domestic solutions, marking the latest move in a long-running tech trade war between the two countries.

Government agencies must now use "safe and reliable" domestic replacements for AMD and Intel chips. The list includes 18 approved processors, including chips from Huawei and the state-backed company Phytium — both of which are banned in the US.

The new rules — introduced in December and quietly implemented recently — could have a significant impact on Intel and AMD. China accounted for 27 percent of Intel's $54 billion in sales last year and 15 percent of AMD's revenue of $23 billion, according to the FT. It's not clear how many chips are used in government versus the private sector, however.

The moves are China's most aggressive yet to restrict the use of US-built technology. Last year, Beijing prohibited domestic firms from using Micron chips in critical infrastructure. Meanwhile, the US has banned a wide range of Chinese companies ranging from chip manufacturers to aerospace firms. The Biden administration has also blocked US companies like NVIDIA from selling AI and other chips to China.

The US, Japan and the Netherlands have dominated the manufacturing of cutting-edge processors, and those nations recently agreed to tighten export controls on lithography machines from ASL, Nikon and Tokyo Electron. However, Chinese companies, including Baidu, Huawei, Xiaomi and Oppo have already started designing their own semiconductors to prepare for a future wherein they could longer import chips from the US and other countries.

GarryB, kvs and lancelot like this post

kvs- Posts : 15131

Points : 15268

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°113

Re: China's development as a superpower

Re: China's development as a superpower

All US CPUs have backdoor hardware. This has been exposed extensively for Intel and AMD is just another US outfit. The US regime

uses private companies to engage in illegal activity such as spying on its own citizens and undermining their constitutional rights.

The abuse of freedom of expression by YouCrap is an example, supposedly it is a private company that can do whatever it wants.

Not. It has exemption from laws that apply to publishers so it is a public square. If it wants editorial freedom to manage the opinions

expressed on its platform, then it needs to be governed by publisher laws.

China now has world class CPUs (the Kirin versions used in its latest cell phones) that are manufactured with domestic EUV high resolution

lithography. It needs to leverage its huge domestic market to advance its CPU manufacturing to the next level and beyond. We see

the problem in Russia when imports simply flood out domestic production since it is extremely expensive to develop high resolution IC

manufacturing. Thanks to NATzO sanctions, Russia is going to see a transition to domestic manufacturing even if it takes 10+ years.

I think that no more "economics" arguments can be made about letting this critical domestic industry languish. China clearly did not

have idiots in charge making "economical" decisions.

uses private companies to engage in illegal activity such as spying on its own citizens and undermining their constitutional rights.

The abuse of freedom of expression by YouCrap is an example, supposedly it is a private company that can do whatever it wants.

Not. It has exemption from laws that apply to publishers so it is a public square. If it wants editorial freedom to manage the opinions

expressed on its platform, then it needs to be governed by publisher laws.

China now has world class CPUs (the Kirin versions used in its latest cell phones) that are manufactured with domestic EUV high resolution

lithography. It needs to leverage its huge domestic market to advance its CPU manufacturing to the next level and beyond. We see

the problem in Russia when imports simply flood out domestic production since it is extremely expensive to develop high resolution IC

manufacturing. Thanks to NATzO sanctions, Russia is going to see a transition to domestic manufacturing even if it takes 10+ years.

I think that no more "economics" arguments can be made about letting this critical domestic industry languish. China clearly did not

have idiots in charge making "economical" decisions.

GarryB and lyle6 like this post

lancelot- Posts : 2696

Points : 2694

Join date : 2020-10-18

- Post n°114

Re: China's development as a superpower

Re: China's development as a superpower

The Chinese have dumped hundreds of billions of dollars into making their own semiconductors at this point. But it's worth it. They import over $300 billion USD in semiconductors from the West each year. They spend more on them than in oil imports.

https://technode.com/2021/04/29/china-spends-more-importing-semiconductors-than-oil/

The Chinese still don't have their own EUV tools though. Even their 28nm DUV tools aren't confirmed to be used in mass production in any fabs yet.

Thus far the Chinese make their 7nm chips with imported lithography tools from the West. In a process similar to TSMC's N7P they use multiple exposures with ArF DUV lithography. According to industry experts it is possible to use these tools all the way down to 5nm. It is just that it might not be price competitive with a process which also uses EUV at 5nm. Intel tried doing this and failed. Thus far no one has done it.

https://technode.com/2021/04/29/china-spends-more-importing-semiconductors-than-oil/

The Chinese still don't have their own EUV tools though. Even their 28nm DUV tools aren't confirmed to be used in mass production in any fabs yet.

Thus far the Chinese make their 7nm chips with imported lithography tools from the West. In a process similar to TSMC's N7P they use multiple exposures with ArF DUV lithography. According to industry experts it is possible to use these tools all the way down to 5nm. It is just that it might not be price competitive with a process which also uses EUV at 5nm. Intel tried doing this and failed. Thus far no one has done it.

kvs likes this post

kvs- Posts : 15131

Points : 15268

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°115

Re: China's development as a superpower

Re: China's development as a superpower

"5 nm" is marketing BS. If some aspect hits this resolution, then that does not make the all IC components uniformly of this resolution.

There is a nice video where an AMD CPU produced by TSMC that is claimed to be a 7 nm FinFet part is dissected. You can clearly see

that the actual resolution is 10 nm. So this AMD part is comparable to the Intel CPUs that are claimed to be coarser than 10 nm.

IC manufacturing is stalled at 10 nm and any talk of 5 nm parts is total BS. ICs stopped uniformly scaling at 90 nm. Since then it has

been assorted "effective" resolution tricks.

The 28 nm value for the Chinese EUV machine is misleading. The resolution is defined by the wavelength and EUV is good enough for

14 nm and 10 nm for that matter. All this IC masturbation is the same as in any other tech field where supposedly the west is in an

another universe compared to all the designated untermenschen.

There is a nice video where an AMD CPU produced by TSMC that is claimed to be a 7 nm FinFet part is dissected. You can clearly see

that the actual resolution is 10 nm. So this AMD part is comparable to the Intel CPUs that are claimed to be coarser than 10 nm.

IC manufacturing is stalled at 10 nm and any talk of 5 nm parts is total BS. ICs stopped uniformly scaling at 90 nm. Since then it has

been assorted "effective" resolution tricks.

The 28 nm value for the Chinese EUV machine is misleading. The resolution is defined by the wavelength and EUV is good enough for

14 nm and 10 nm for that matter. All this IC masturbation is the same as in any other tech field where supposedly the west is in an

another universe compared to all the designated untermenschen.

lancelot- Posts : 2696

Points : 2694

Join date : 2020-10-18

- Post n°116

Re: China's development as a superpower

Re: China's development as a superpower

Ever since transistors stopped being planar in the 28/22nm node the physical dimensions of the gate stopped scaling down the way they originally did. The problem isn't being able to etch smaller details on the wafer. It's that the transistor needs to be able to keep enough electron charge to operate and the transistor walls cannot be made thinner without losing electron charge. But the transistors are still getting smaller because they switched to a different transistor architecture with FinFET i.e. the transistors are being made taller to keep more electrons inside while still reducing overall dimensions.

Since 28/22nm the numbers like you say are just marketing speak similar to the PR rating scheme back in the Pentium days that AMD and Cyrix used. They are just indicative of expected technological level vs some theoretical transistor of that dimension which cannot be manufactured in practice because it wouldn't hold charge. But for all intents and purposes the scaling down of logic is continuing. Just compare the amount of transistors per area of different processes.

Since 28/22nm the numbers like you say are just marketing speak similar to the PR rating scheme back in the Pentium days that AMD and Cyrix used. They are just indicative of expected technological level vs some theoretical transistor of that dimension which cannot be manufactured in practice because it wouldn't hold charge. But for all intents and purposes the scaling down of logic is continuing. Just compare the amount of transistors per area of different processes.

higurashihougi- Posts : 3104

Points : 3191

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°117

Re: China's development as a superpower

Re: China's development as a superpower

https://www.tomshardware.com/tech-industry/semiconductors/smic-and-huawei-could-use-quadruple-patterning-for-chinese-5nm-chips-report

SMIC and Huawei could use quadruple patterning for China-made 5nm chips: Report

Huawei and presumably China's Semiconductor Manufacturing International Co. (SMIC) have submitted patents for a chip production method called self-aligned quadruple patterning (SAQP). The ultimate aim is to produce chips on a 5nm-class process technology, according to a Bloomberg report.

The very same method was a major reason for the failure of Intel’s 1st Generation 10nm-class process technology, but Huawei and SMIC have no choice but to use quadruple patterning as they do not have access to leading-edge production tools due to U.S. export rules.

Usage of SAQP could enable SMIC to build chips on sub-10nm technologies (we are talking about SMIC’s rumored 5nm fabrication process) despite U.S. efforts to limit China’s capabilities in the field of advanced semiconductor production. In Intel’s case, SAQP technology was meant to eliminate reliance on high-end lithography, specifically extreme ultraviolet (EUV) lithography machines made by ASML. In the Huawei and SMIC case, quadruple patterning is the only technique that increases transistor density using the tools that the contract chipmaker already has.

The SAQP method described in Huawei's patent application involves etching lines on silicon wafers multiple times to boost transistor density, reduce power consumption, and potentially increase performance. This approach could allow for the production of more sophisticated chips than those that SMIC already produces for Huawei, including the Kirin 9000S. SiCarrier, a state-backed chipmaking gear developer working with Huawei, has also been granted a patent that involves multipatterning, according to Bloomberg, which again confirms SMIC's plans to use this technology for its next-generation nodes.

Despite the potential of quadruple-patterning technology to enable China to manufacture 5nm-class chips, experts like Dan Hutcheson, vice-chairman at TechInsights, believe that China will eventually need to acquire or develop EUV machines for long-term competitiveness beyond 5nm-class nodes. If Huawei and its partners resort to alternative methods for semiconductor production, their cost per chip may exceed what is economically feasible for commercial devices like PCs and smartphones. Then again, processors used for supercomputers, which in turn could be used for developing weapons including weapons of mass destruction, don't need to pay heed to commercial economic restrictions.

While developing weapons may be important for China, the advancements in chip technology are crucial for the country's economy. Nowadays it is largely based on demand from within the country and somehow buyers in China would like to possess competitive products, such as an iPhone from Apple. This is where Huawei may use the tech, for consumer system-on-chip design, but its chipmaking partner SMIC has to catch up and this ultimately involves acquiring advanced chipmaking process technologies.

SMIC and Huawei could use quadruple patterning for China-made 5nm chips: Report

Huawei and presumably China's Semiconductor Manufacturing International Co. (SMIC) have submitted patents for a chip production method called self-aligned quadruple patterning (SAQP). The ultimate aim is to produce chips on a 5nm-class process technology, according to a Bloomberg report.

The very same method was a major reason for the failure of Intel’s 1st Generation 10nm-class process technology, but Huawei and SMIC have no choice but to use quadruple patterning as they do not have access to leading-edge production tools due to U.S. export rules.

Usage of SAQP could enable SMIC to build chips on sub-10nm technologies (we are talking about SMIC’s rumored 5nm fabrication process) despite U.S. efforts to limit China’s capabilities in the field of advanced semiconductor production. In Intel’s case, SAQP technology was meant to eliminate reliance on high-end lithography, specifically extreme ultraviolet (EUV) lithography machines made by ASML. In the Huawei and SMIC case, quadruple patterning is the only technique that increases transistor density using the tools that the contract chipmaker already has.

The SAQP method described in Huawei's patent application involves etching lines on silicon wafers multiple times to boost transistor density, reduce power consumption, and potentially increase performance. This approach could allow for the production of more sophisticated chips than those that SMIC already produces for Huawei, including the Kirin 9000S. SiCarrier, a state-backed chipmaking gear developer working with Huawei, has also been granted a patent that involves multipatterning, according to Bloomberg, which again confirms SMIC's plans to use this technology for its next-generation nodes.

Despite the potential of quadruple-patterning technology to enable China to manufacture 5nm-class chips, experts like Dan Hutcheson, vice-chairman at TechInsights, believe that China will eventually need to acquire or develop EUV machines for long-term competitiveness beyond 5nm-class nodes. If Huawei and its partners resort to alternative methods for semiconductor production, their cost per chip may exceed what is economically feasible for commercial devices like PCs and smartphones. Then again, processors used for supercomputers, which in turn could be used for developing weapons including weapons of mass destruction, don't need to pay heed to commercial economic restrictions.

While developing weapons may be important for China, the advancements in chip technology are crucial for the country's economy. Nowadays it is largely based on demand from within the country and somehow buyers in China would like to possess competitive products, such as an iPhone from Apple. This is where Huawei may use the tech, for consumer system-on-chip design, but its chipmaking partner SMIC has to catch up and this ultimately involves acquiring advanced chipmaking process technologies.

GarryB and lancelot like this post

lancelot- Posts : 2696

Points : 2694

Join date : 2020-10-18

- Post n°118

Re: China's development as a superpower

Re: China's development as a superpower

On each further process you want to use multiple exposures to reach a lower resolution the amount of passes grows exponentially. Because of the complexity of the passes the possibility of manufacturing defects also increases. Some people claim this means after 7nm using EUV in some layers is more cost effective (TSMC, Samsung, and Intel seem to currently believe this). Others claim it is possible to go to 5nm and still be cost effective because even with more passes the equipment and materials for ArF DUV are cheaper than for EUV.

Intel indeed tried, and failed, to get to 5nm with ArF DUV. Some claim it was with SAQP others claim it was with some other process they were trying to come up with and failed to get working with any decent yield. It would tens of billions at this point to upgrade all the Intel fabs to EUV. The existing fabs are a depreciated asset at this point. The further they could continue using them to generate revenue the better it would be financially for them. Unfortunately for Intel they failed at this and had to reach deep into their pockets, and then some, to move to EUV.

SAQP itself is nothing new. Several companies use it in 7nm ArF DUV processes for the most critical layers. Including Intel. But they couldn't get it to work at 5nm.

If the Chinese pull this off they will succeed where Intel, and indeed the rest of the chip manufacturing businesses, failed.

Intel indeed tried, and failed, to get to 5nm with ArF DUV. Some claim it was with SAQP others claim it was with some other process they were trying to come up with and failed to get working with any decent yield. It would tens of billions at this point to upgrade all the Intel fabs to EUV. The existing fabs are a depreciated asset at this point. The further they could continue using them to generate revenue the better it would be financially for them. Unfortunately for Intel they failed at this and had to reach deep into their pockets, and then some, to move to EUV.

SAQP itself is nothing new. Several companies use it in 7nm ArF DUV processes for the most critical layers. Including Intel. But they couldn't get it to work at 5nm.

If the Chinese pull this off they will succeed where Intel, and indeed the rest of the chip manufacturing businesses, failed.

higurashihougi- Posts : 3104

Points : 3191

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°119

Re: China's development as a superpower

Re: China's development as a superpower

https://www.rt.com/business/596472-iphone-sales-drop-china/

iPhone sales nosedive in China

Apple has continued to shed market share to local smartphone makers, including Huawei

Apple’s smartphone sales in China dropped 19% in the first quarter of 2024 due to increased competition from local brands, a new report by Counterpoint Research has shown.

The US tech giant fell to third place in the hotly contested market amid pressure from fast-rising rival Huawei, the researcher said on Tuesday.

Shenzhen-based Huawei saw sales of its smartphones soar a whopping 69.7% in the first quarter. It is now the fourth-largest smartphone maker in China, according to the report.

Huawei’s strong performance comes in the wake of US sanctions, which nearly wiped out the Chinese company’s global smartphone business.

Overall, China’s smartphone market expanded about 1.5% year-on-year in the first quarter of 2024, marking the second quarter of positive growth for the industry.

Vivo became the top smartphone vendor in China during the quarter with a 17.4% share, driven by strong sales of the Y35 Plus and Y36 models in the low-end segment and the S18 in the mid-end segment. Honor ranked second with a 16.1% share, followed by Apple with a 15.7% share.

“Apple’s sales were subdued during the quarter as Huawei’s comeback has directly impacted Apple in the premium segment,” senior Counterpoint analyst Ivan Lam stated. “Besides, the replacement demand for Apple has been slightly subdued compared to previous years.”

The sales drop highlights the challenges Apple faces in its third-largest market, where some Chinese companies and government entities bar the use of its devices in retaliation to restrictions the US placed on Chinese apps for supposed security reasons.

Analysts anticipate increased pressure on Apple’s sales in 2024. Research firm IDC previously warned that the US tech giant’s presence in China has been dented by rival products and limited product upgrades by Apple, which has reduced the overall attractiveness of iPhones.

Apple, once the world’s most valuable company, has seen its shares fall 14% this year, underperforming the overall market. Its market valuation is still $2.56 trillion, second only to Microsoft Corporation.

iPhone sales nosedive in China

Apple has continued to shed market share to local smartphone makers, including Huawei

Apple’s smartphone sales in China dropped 19% in the first quarter of 2024 due to increased competition from local brands, a new report by Counterpoint Research has shown.

The US tech giant fell to third place in the hotly contested market amid pressure from fast-rising rival Huawei, the researcher said on Tuesday.

Shenzhen-based Huawei saw sales of its smartphones soar a whopping 69.7% in the first quarter. It is now the fourth-largest smartphone maker in China, according to the report.

Huawei’s strong performance comes in the wake of US sanctions, which nearly wiped out the Chinese company’s global smartphone business.

Overall, China’s smartphone market expanded about 1.5% year-on-year in the first quarter of 2024, marking the second quarter of positive growth for the industry.

Vivo became the top smartphone vendor in China during the quarter with a 17.4% share, driven by strong sales of the Y35 Plus and Y36 models in the low-end segment and the S18 in the mid-end segment. Honor ranked second with a 16.1% share, followed by Apple with a 15.7% share.

“Apple’s sales were subdued during the quarter as Huawei’s comeback has directly impacted Apple in the premium segment,” senior Counterpoint analyst Ivan Lam stated. “Besides, the replacement demand for Apple has been slightly subdued compared to previous years.”

The sales drop highlights the challenges Apple faces in its third-largest market, where some Chinese companies and government entities bar the use of its devices in retaliation to restrictions the US placed on Chinese apps for supposed security reasons.

Analysts anticipate increased pressure on Apple’s sales in 2024. Research firm IDC previously warned that the US tech giant’s presence in China has been dented by rival products and limited product upgrades by Apple, which has reduced the overall attractiveness of iPhones.

Apple, once the world’s most valuable company, has seen its shares fall 14% this year, underperforming the overall market. Its market valuation is still $2.56 trillion, second only to Microsoft Corporation.

|

|

|

ALAMO

ALAMO