Russia Faces Economy Trap as Oil Decline Looms, EBRD Says

By Henry Meyer and Agnes Lovasz on December 14, 2012

Russia, the world’s largest energy exporter, is becoming increasingly dependent on commodities and failing to prepare for falling oil output in 20 years, the European Bank for Reconstruction & Development said.

Corruption, poor education, immigration barriers and state dominance in the economy, which curbs private innovation, all hinder diversification, which is Russia’s key challenge, the London-based EBRD said in a report published today.

Oil and natural gas account for almost 70 percent of exports and about half of budget revenue. The economy’s dependence on energy is greater today than in the mid-1990s, when it represented less than half of exports, according to the EBRD. The non-commodity share of exports fell to as little as 8 percent in 2011 from 15 percent in 1997.

“If you look at all the talk, all the effort, over the last 10 years, very little has happened and you can argue that it has got worse,” Erik Berglof, the EBRD’s chief economist, said at a presentation today in Moscow. “Even Brezhnev talked about the need to diversify,” he said, referring to Soviet leader Leonid Brezhnev, who led the Soviet Union from 1964 until his death in 1982, a period characterized as an era of stagnation that paved the way for the country’s 1991 collapse.

Price Swings

President Vladimir Putin, who extended his 12-year rule this year after enduring the biggest unrest since he came to power, said in his annual state-of-the-nation address on Dec. 12 that Russia needs to reduce its vulnerability to sudden swings in commodity prices.

Under current estimates, Russia’s known oil reserves, including fields in the Arctic, are enough to sustain the current rate of production for just 20 years, according to the EBRD. Kazakhstan, by comparison, can sustain current output for 60 years, Saudi Arabia for more than 70 years and the United Arab Emirates for more than 90 years, the EBRD said.

Russia’s government doesn’t publish its own estimate of oil reserves, which are considered a state secret. The EBRD cited BP Plc data in its calculations. Russian crude oil and condensate production climbed to a post-Soviet record of 10.503 million barrels a day in November, a post-Soviet high, according to preliminary estimates from the Energy Ministry’s CDU-TEK unit.

‘Petro-State’

“The problem of being a petro-state is that natural resource trends corrupt the institutions,” Sergei Guriev, rector of the New Economic School in Moscow and a government adviser who contributed to the EBRD report, said in an interview. “This is what is called the resource curse. This is a trap, where democratic political and economic institutions do not develop because rents coming from natural resources provide incentives to the elite not to develop institutions.”

Russia’s economy grew at 7 percent a year on average during Putin’s 2000-2008 presidencies then contracted almost 8 percent in 2009 after crude prices plunged to $34 a barrel from $147. The current resource-based economy can’t deliver the growth rate of 5 percent to 6 percent that Russia needs over the next few decades, Putin said in his Dec. 12 address.

‘Non-State Capitalism’

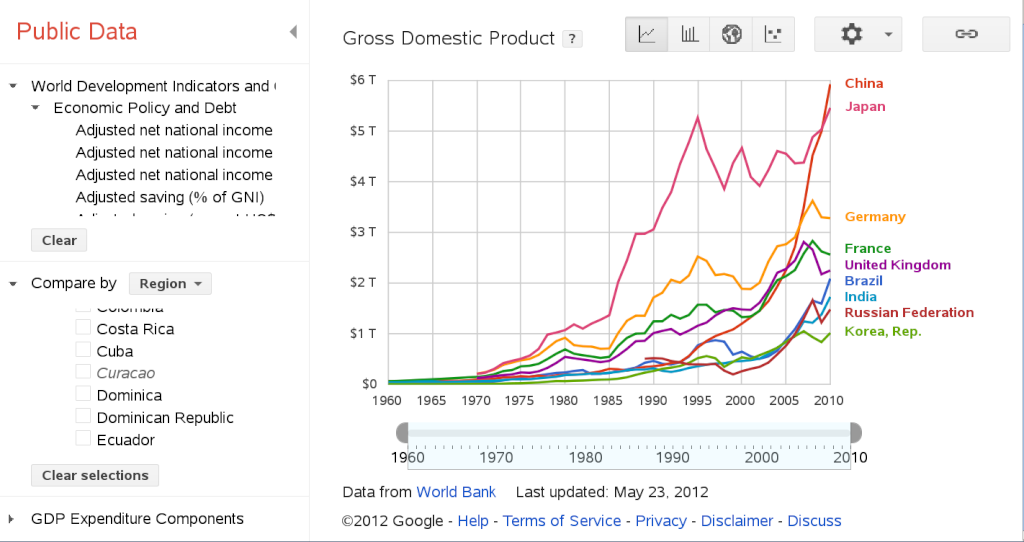

Russia is facing a fourth-straight quarter of slowing growth as weakening demand from China and Europe hurts exports and a surge in inflation saps consumer purchasing power. Gross domestic product will advance 3.5 percent in 2012, according to the government, slowing from last year’s 4.3 percent expansion. GDP will expand 3.5 percent next year, according to the median estimates of 35 economists in a Bloomberg survey last month.

“A real change in the structure of the economy, the creation of new industrial sectors and the restoration of our leadership in traditional ones, the development of small and medium-sized businesses -- these are key issues,” Putin said. “I am sure that at the center of the new economic model should be economic freedom, private property and non-state capitalism.”

Russian’s investment in promoting high-tech industries -- with public money accounting for 75 percent of research and development funding -- has yielded only limited results, the EBRD said.

‘Vicious Circle’

While China and India have both “dramatically” increased the percentage of exports of goods and services accounted for by information and communications technology, Russia still has barely 20 percent of manufacturing exports with a high skill content, the bank said.

A survey carried out by the EBRD and the World Bank in 2011-2012 in 37 of Russia’s 83 regions found that most of the 4,000 manufacturing and services companies that took part saw corruption, skilled-labor shortages and a lack of funding as the main obstacles to doing business. Only 3 percent of Russian companies exported in 2008-2009, compared with 15 percent to 17 percent in France and the U.S.

“Non-resource sectors need property-rights protection, courts and good financial markets,” said Guriev. “All of those require good political institutions and so it’s a vicious circle.”

State-owned companies account for about half of Russia’s economic output, or $1.14 trillion, according to BNP Paribas SA’s Moscow unit. That’s up from about 42 percent in 2008 and 38 percent in 2006 and doesn’t take into account state-run OAO Rosneft’s acquisition of TNK-BP, BP’s venture with a group of billionaires, BNP said in an Oct. 22 research note.

The EBRD, owned by 63 countries and two intergovernmental institutions, was created in 1991 to invest in former communist countries and help them transform their economies. It’s expanding its scope to promoting market economies in North Africa, the Middle East and Turkey.

http://www.businessweek.com/news/2012-12-13/russia-at-risk-from-dwindling-oil-reserves-european-bank-says