This is intended to be a thread on the trope that Russia depends on oil and gas exports for its economic survival. Western coverage

of Russia repeats this lie in true Goebbels style. It has become common wisdom in the west that Russia "does not make anything"

and is a gas and oil pump.

Please keep any posts in this thread strictly on this narrow subject. It is intended as a FAQ that will develop over time. It is not easy

to debunk western misinformation using western sources.

A good starting point are the following links:

https://www.awaragroup.com/blog/russian-economy-2014-2016-the-years-of-sanctions-warfare/

https://www.awaragroup.com/blog/russian-economy-strong-and-stable/

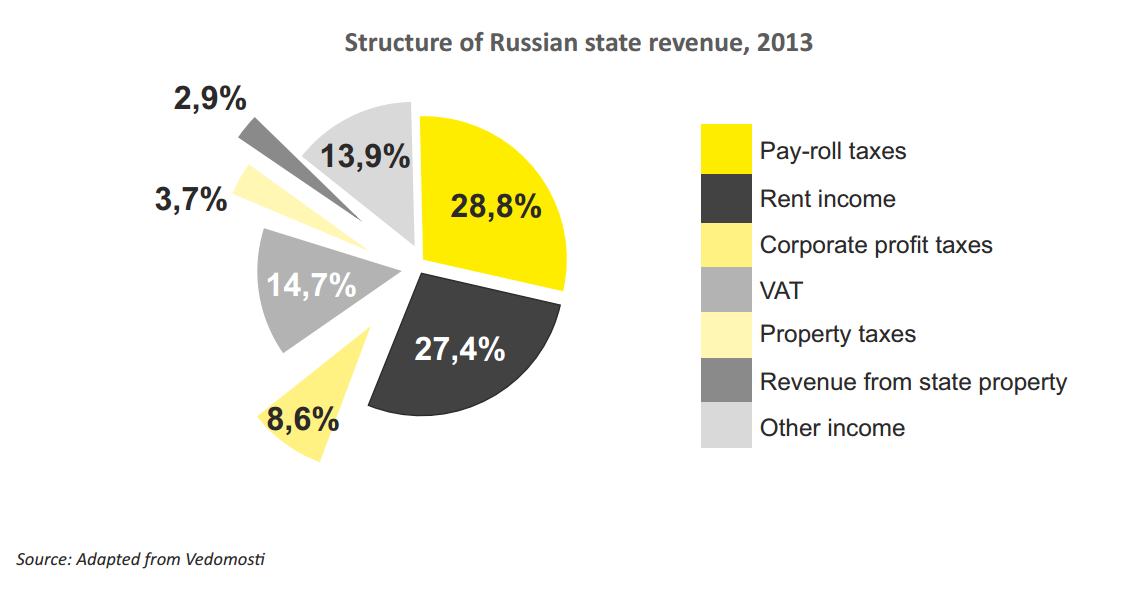

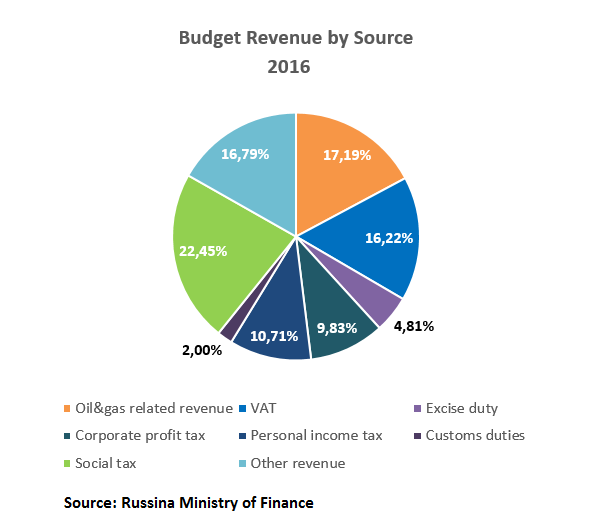

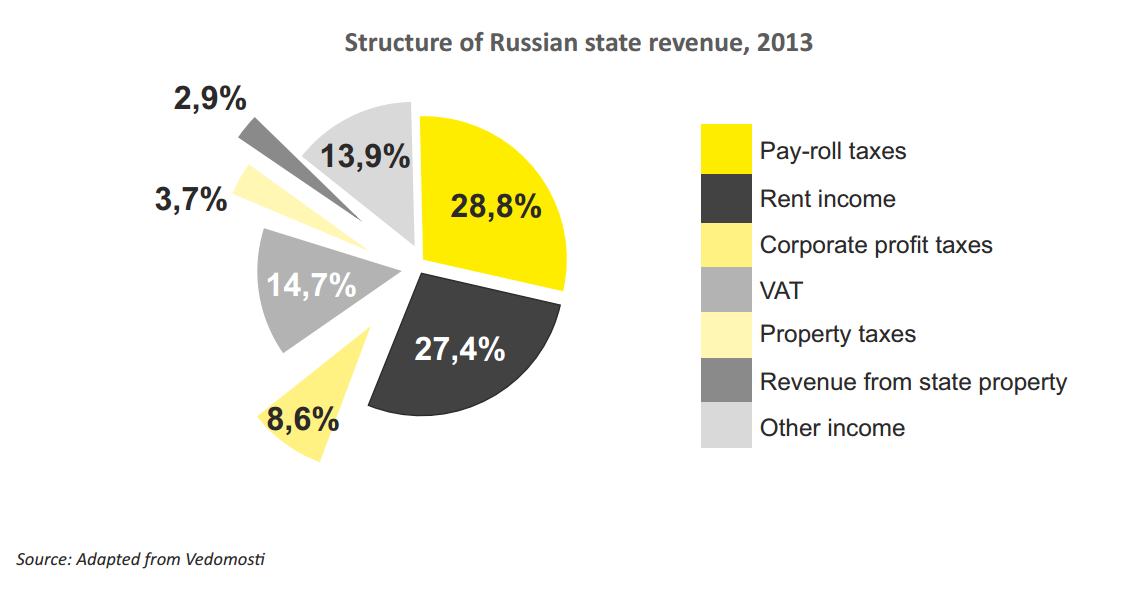

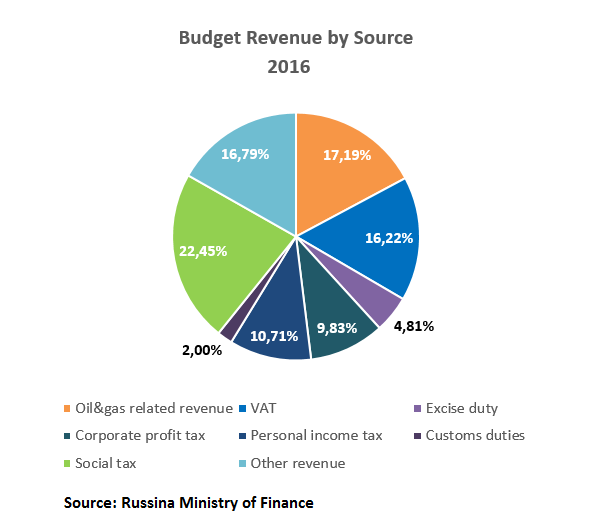

1) Share of Oil and Gas Taxes in the Federal budget of Russia.The pivot of the nonsense about Russian oil and gas export dependence. Routinely the tax fraction is confused as GDP fraction. They

have nothing in common. Russia has a 13% flat income tax. It chooses to tax resource extraction instead of the public.

Rent income includes resource rents such as oil and gas taxes. Not apartment rent.

Oil & gas related revenue made up only 17% of the total consolidated budget revenue in 2016.

Contemplating these figures that disprove the claim of Russia’s supposed hydrocarbon dependency, US senator John McCain, aka McInsane, pops to mind. He infamously quipped that “Russia is a gas station masquerading as a country.”

There are two budgets being bandied about in the MSM. One is the narrow federal budget, the other is the consolidated government budget. Russia

does not have provinces or states. It has the federal level and municipal levels. So called "oblasts" in Russia outside of special ethnic zones are like

counties or townships in North America. Since oil and gas are being discussed in the context of Russia's economy, the consolidated budget is the only

relevant one. As for the fraction of oil and gas taxes in the narrow federal budget, they were 36% in 2016. The endlessly repeated figure of 50% is

BS.

Again, taxing resource rents is smart. It removes the tax burden from consumers, who drive the GDP in developed countries, and puts it literally onto

foreigners who pay for Russia's oil and gas exports. Trying to paint this is a fail takes the cake for cheeseball propaganda.

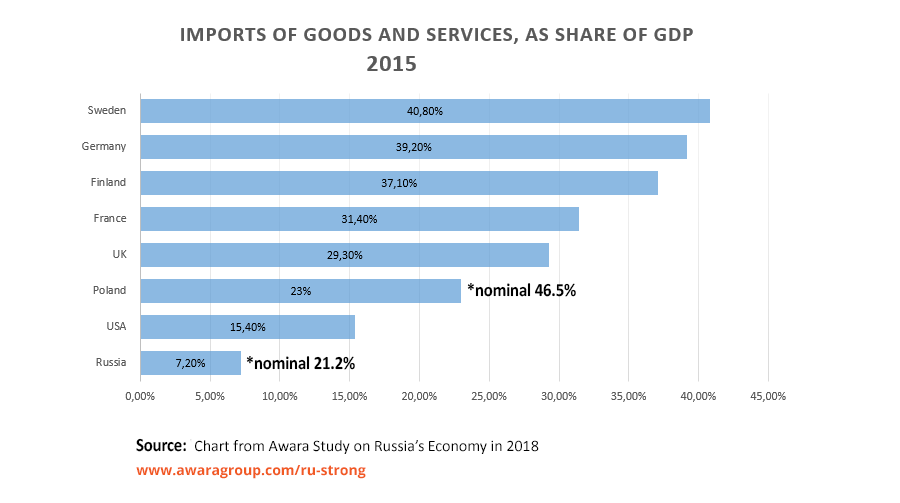

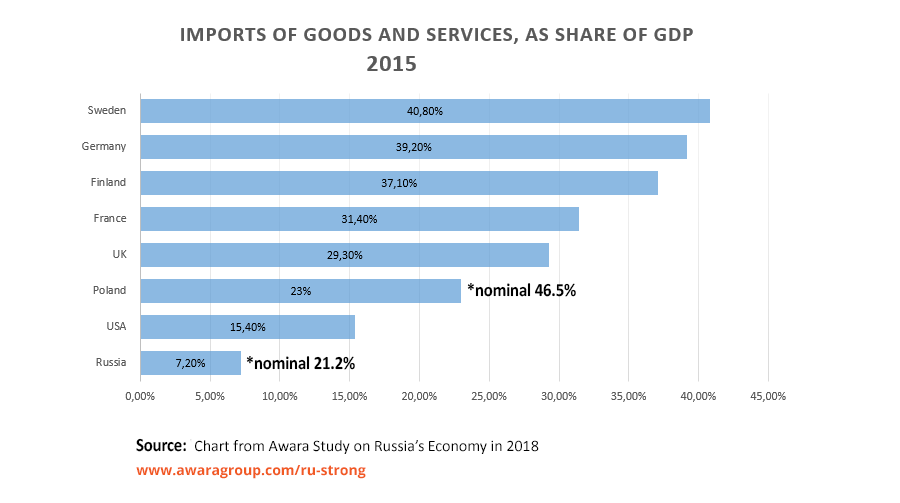

2) Diversification of Russia's Economy The claim that Russia is an oil banana republic is based on the ludicrous notion that its export profile reflects its economic profile as if there is some

law of nature that mirrors exports to reflect the economic profile of any country. This amateur hour drivel is easily debunked by a real measure of

Russia's economic diversification, its imports profile.

Russia is less dependent on imports than the USA and much less compared to Europe. The supposedly rich and diversified Europe (Germany, France, UK, etc.)

The relevance of this metric is that banana republics do not produce and cannot produce what they need to function domestically. They use their commodity

exports to import all the other essentials necessary to function as countries. For example, machinery, medicine and even food. If Russia was some oil banana

republic "which does not make anything", it would be much more import dependent than Sweden and similar to Saudi Arabia. Yet the western fake stream

media never rides Saudi a** like it attempts to ride Russia's. Thus the western media has zero credibility.

3) Don't Shoot the MessengerI am sure some will try to fob off Awara as "Putin's propaganda outfit". Whatever that means. But if you prefer to cherry pick your sources instead of

dealing with data that "can't possibly be true", then consider the World Bank. Unless it is in Putin's pocket also.

https://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS

The resource rents for Russia for 2019 estimated by the World Bank are 13.1%

https://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS?locations=RU

https://data.worldbank.org/indicator/NY.GDP.PETR.RT.ZS?locations=RU

Looking at the graph of this metric over the last 30+ years it needs some context. In 2016 the resource rents were 8.6% so it depends on the nominal

price of oil and gas exports but confounded by some adjustments. The oil rents for 2019 were 9.2%. This figure appears to include natural gas since

there is a separate coal rents category but not gas.

https://tradingeconomics.com/commodity/crude-oil

The minima in the World Bank data for resource rents in Russia correspond to minima in world oil prices. But the shape is different. In particular, the

increase after 2016 is not consistent with the oil price (and the gas price which is indexed to the oil price for Russia's exports). Anyway, according

to the World Bank oil and gas account for 9% of Russia's GDP. Not 50%.